Southeast Asia: Market overview

Southeast Asia, comprising 11 countries with a total population of 700 million, has a thriving economy with a collective GDP nearing $4 trillion. The region’s construction industry plays a crucial role in economic development, valued at $530 billion in 2024, and is expected to grow at a CAGR of 6% from 2024 to 2028. Construction contributes between 5 to 10% of each nation’s GDP, signifying its centrality to economic activity. For the sick.

Main Construction Segments & Growth Drivers

The construction industry in Southeast Asia can be divided into four primary segments, each with unique growth drivers:

1. Civil & Infrastructure

- Scope: Includes transportation (roads, railways), energy (renewable energy projects), water and sanitation, telecommunications, ports, and pipelines.

- Drivers: Significant investments in infrastructure, especially in transportation, data and clean energy projects.

2. Residential

- Scope: Encompasses housing for single families, multifamily units, student accommodations, and senior living.

- Growth potential: The region is facing a housing shortage, with 50 million new units needed by 2030.

3. Commercial

- Scope: Office buildings, retail spaces, and mixed-use developments.

- Outlook: The commercial real estate sector is expected to expand from $3.6 trillion in 2022 to $4 trillion by 2030.

4. Industrial

- Scope: Focuses on manufacturing plants, warehouses, logistics facilities, and data centers.

- Key driver: The cloud services market in Southeast Asia is projected to reach $150 billion by 2026, growing at a CAGR of over 23%.

Key Challenges and Opportunities

Challenges

While the region’s construction industry is expanding rapidly, it faces several challenges that inhibit its full potential. These include:

- Skilled labor shortages: A significant gap in skilled workers, leading to project delays and increased costs.

- Rising material costs: Volatile material prices, particularly for energy-intensive materials, squeeze profit margins.

- Housing affordability crisis: A shortage of affordable housing in many areas.

- Intense competition and thin margins: Intense competition in the sector has led to lower profit margins, limiting innovation and growth.

- Regulatory complexity: Varying regulations across countries create uncertainties in project execution.

- Low tech adoption: Resistance to adopting digital tools and modern technology hinders productivity and innovation.

Opportunities for ConTech

These challenges create a $530 billion market opportunity for ConTech companies, offering solutions that can:

- Increase Efficiency: Streamline operations and reduce waste.

- Improve Quality: Enhance construction quality and reduce defects.

- Cut Costs: Optimize resource use and reduce project overruns.

- Enhance Sustainability: Promote greener, more sustainable building practices.

- Improve Safety: Reduce workplace injuries and accidents.

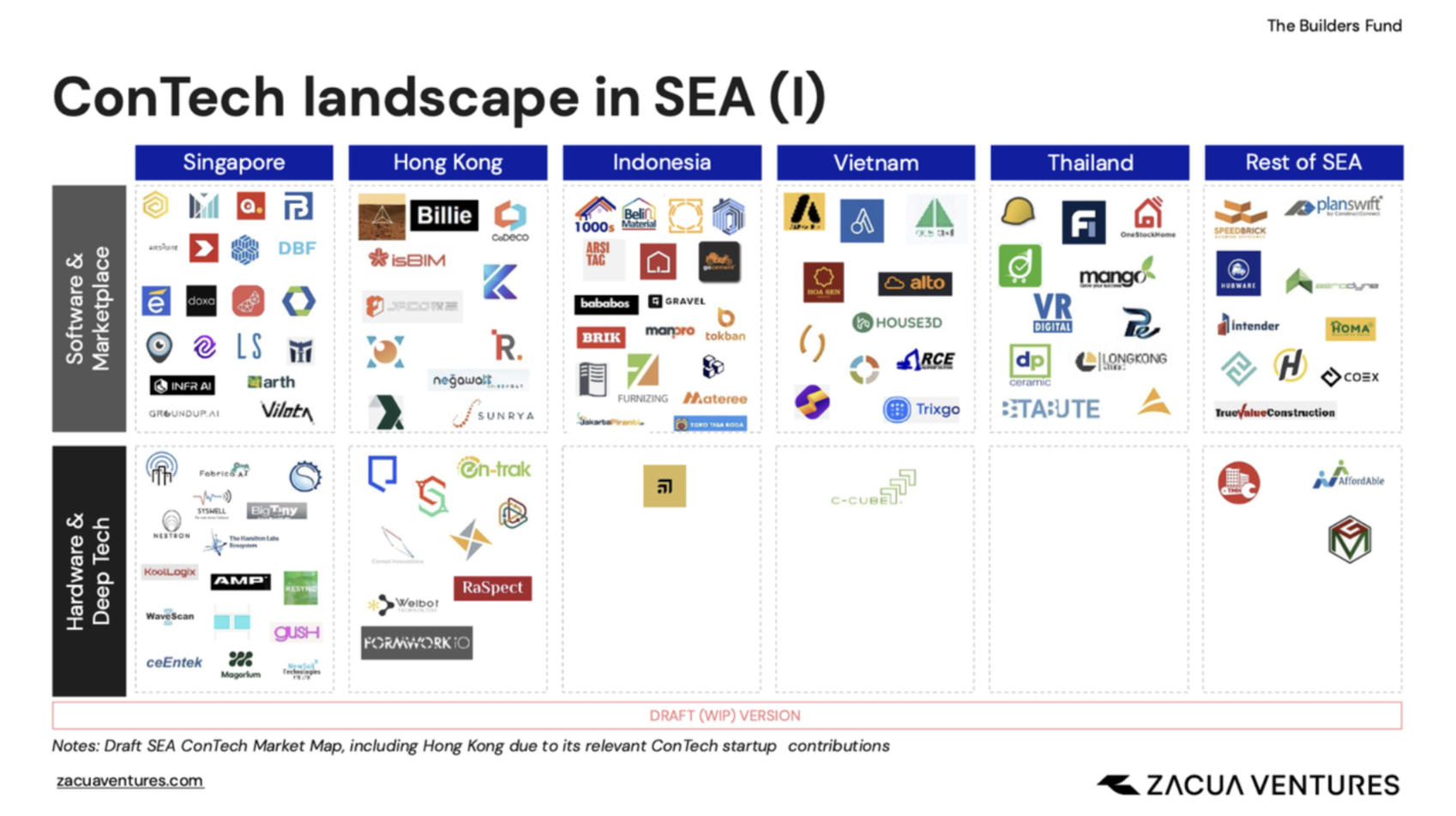

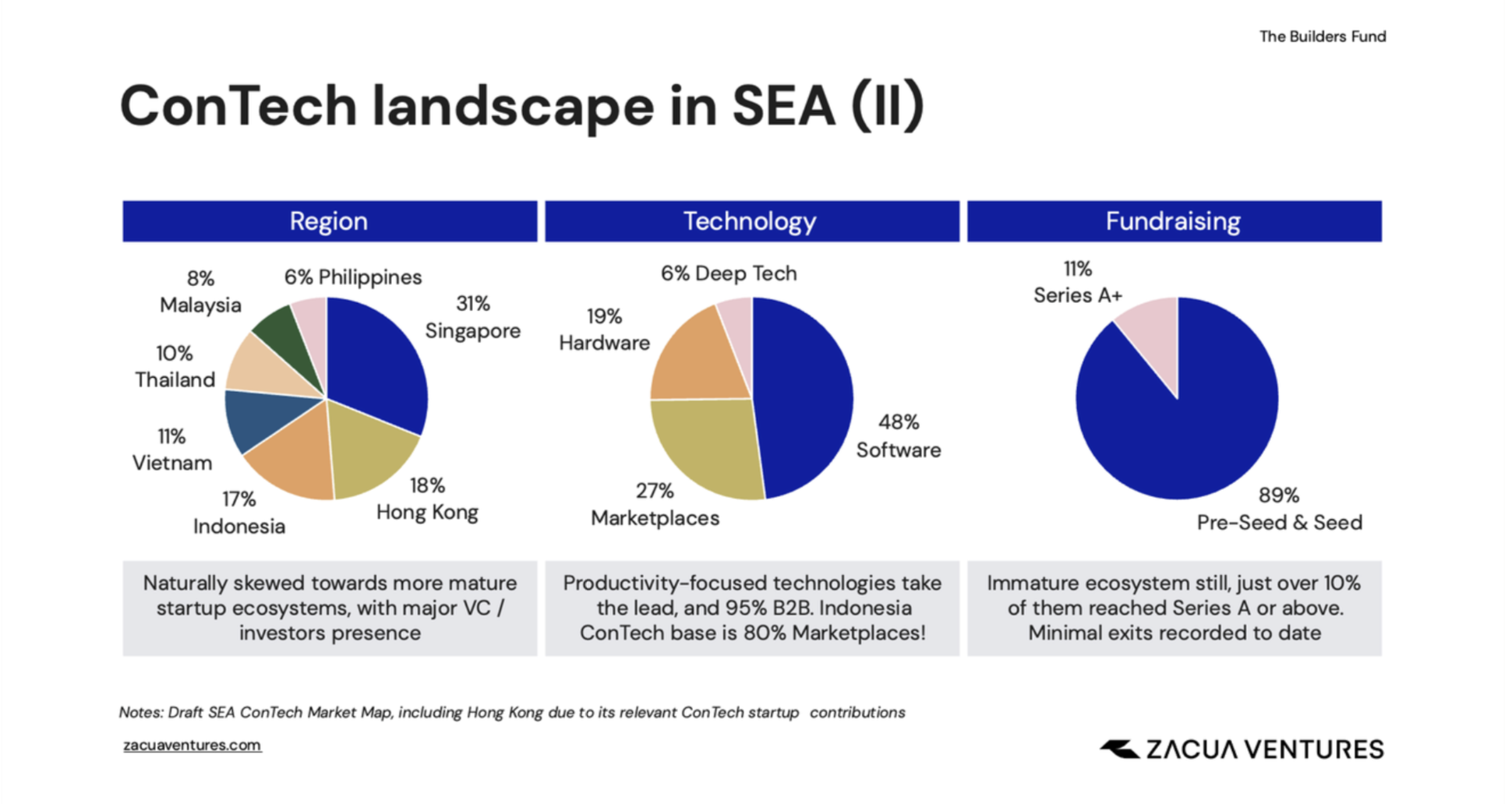

External sources point out that over 400 ConTech startups operate in the SEA region, our finding shows the real (active) ConTech startup figure is much lower, standing at 120 ConTech startups at the moment.

ConTech Ecosystem by Country

Adoption is still low: Construction management tools and Prefab/DFMA are the most widely used technologies, but adoption remains low, primarily due to the traditional, risk-averse mindset of the industry. The vast majority of construction projects are still self-constructed, delivered by smaller players. This leads to a highly fragmented market, with the long tail of smaller operators remaining underserved.

Southeast Asia’s ConTech ecosystem is diverse, with countries at different stages of growth and technology adoption:

1. Singapore

- Focus: Singapore is the regional hub for ConTech startups.

- Strengths: Its mature startup ecosystem and strong VC presence foster software and hardware innovation in areas like robotics and AI.

2. Indonesia

- Focus: The ConTech scene is nascent, with a strong emphasis on B2B marketplaces addressing the fragmented market.

- Outlook: As the largest market in the region, Indonesia offers significant potential for early-stage startups.

3. Vietnam

- Focus: Software-based ConTech startups dominate here, leveraging Vietnam’s growing tech talent pool and government support.

4. Thailand

- Focus: A balanced mix of hardware, software, and marketplace ConTech startups, supported by a robust manufacturing base.

5.Other countries (Malaysia, Philippines, Hong Kong)

- Focus: Each of these regions has unique characteristics that contribute to the overall ecosystem.

Funding Landscape and Maturity

Funding across Southeast Asia’s ConTech ecosystem varies by country:

- Singapore and Hong Kong: More mature markets with significant Series A funding and beyond.

- Indonesia: A large ecosystem, but early-stage funding (pre-seed and seed) dominates.

- Other southeast asian countries: The startup scene is still developing, with early-stage investment being the primary focus.

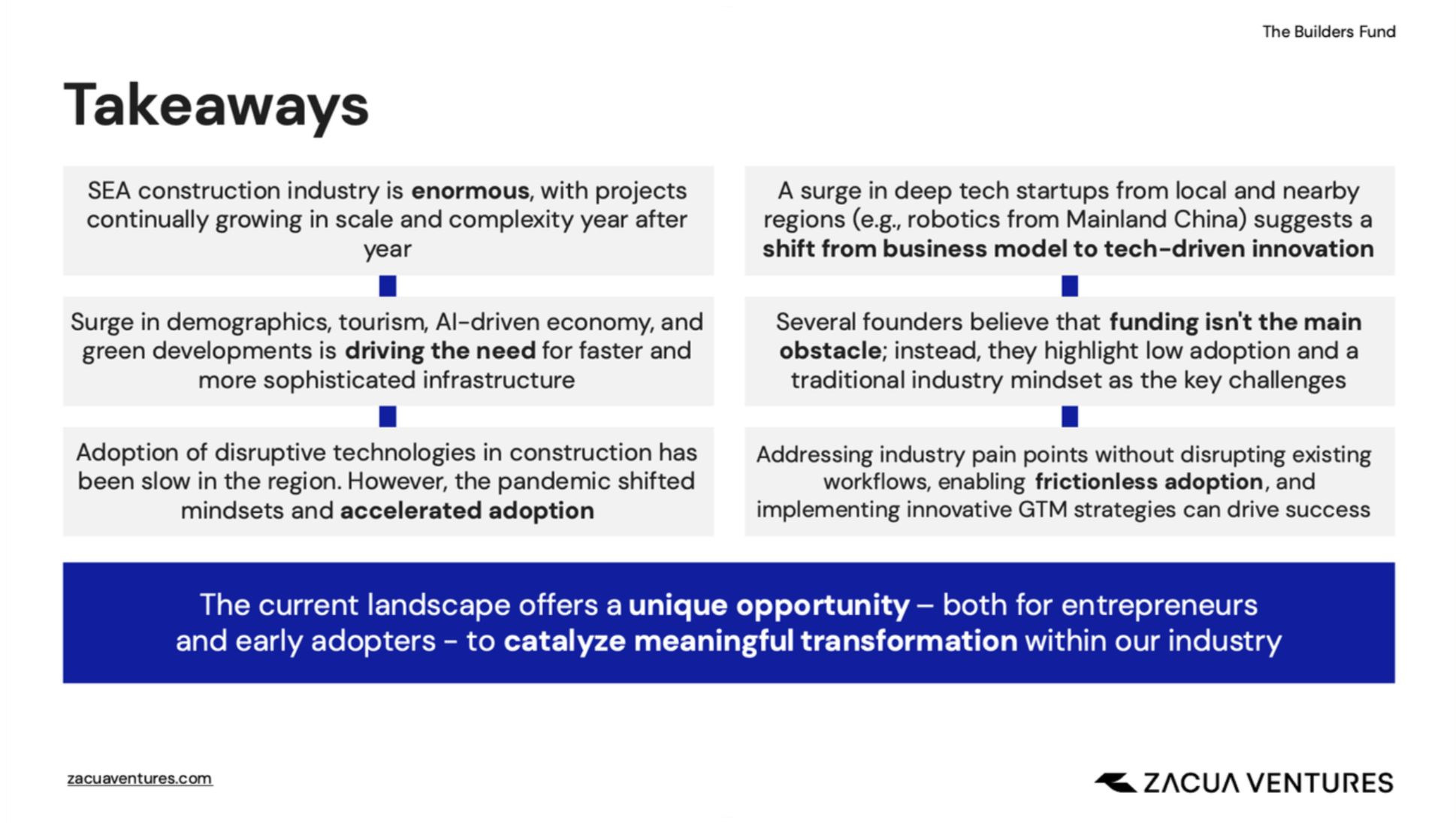

Key Trends and Takeaways

Strategic Insights

- Sustainability focus: There is a rising demand for sustainable buildings and infrastructure.

- Prefab construction: Prefab methods are gaining popularity as a faster and more cost-efficient approach to large projects.

- Data-driven decision making: AI and data analytics are poised to play a pivotal role in enhancing project outcomes.

- Government support: Governments across the region are recognizing the role of ConTech in economic growth and are starting to offer more support for startups.