Following a challenging 2023 market marked by widespread decline in VC investment, a substantial decrease in startup valuations, and an overall challenging fundraising landscape for startups (thereby creating a favorable scenario for funds with available capital), we now arrive into 2024 facing diverse geopolitical challenges, economic uncertainties and the highest interest rates in over a decade.

To gauge the pulse of the market, we conducted our Annual Contech Investment Climate Survey, now in the second year, with input from 114 VC and CVC firms to understand their investment sentiment and foresee trends for the 2024 Contech fundraising environment.

All charts data is based on 114 unique fund responses surveyed between November and December 2023, including, primarily, VC and CVC funds that have Construction Technology as one of their major areas of investment. Majority of the surveyed funds invest in North America and Europe and focus in early stages (Pre-seed to Series B).

At the end of the analysis, we have included some segment-specific answers: A) segmentation based on stage of investment and B) regional segmentation.

SURVEY TAKEAWAYS

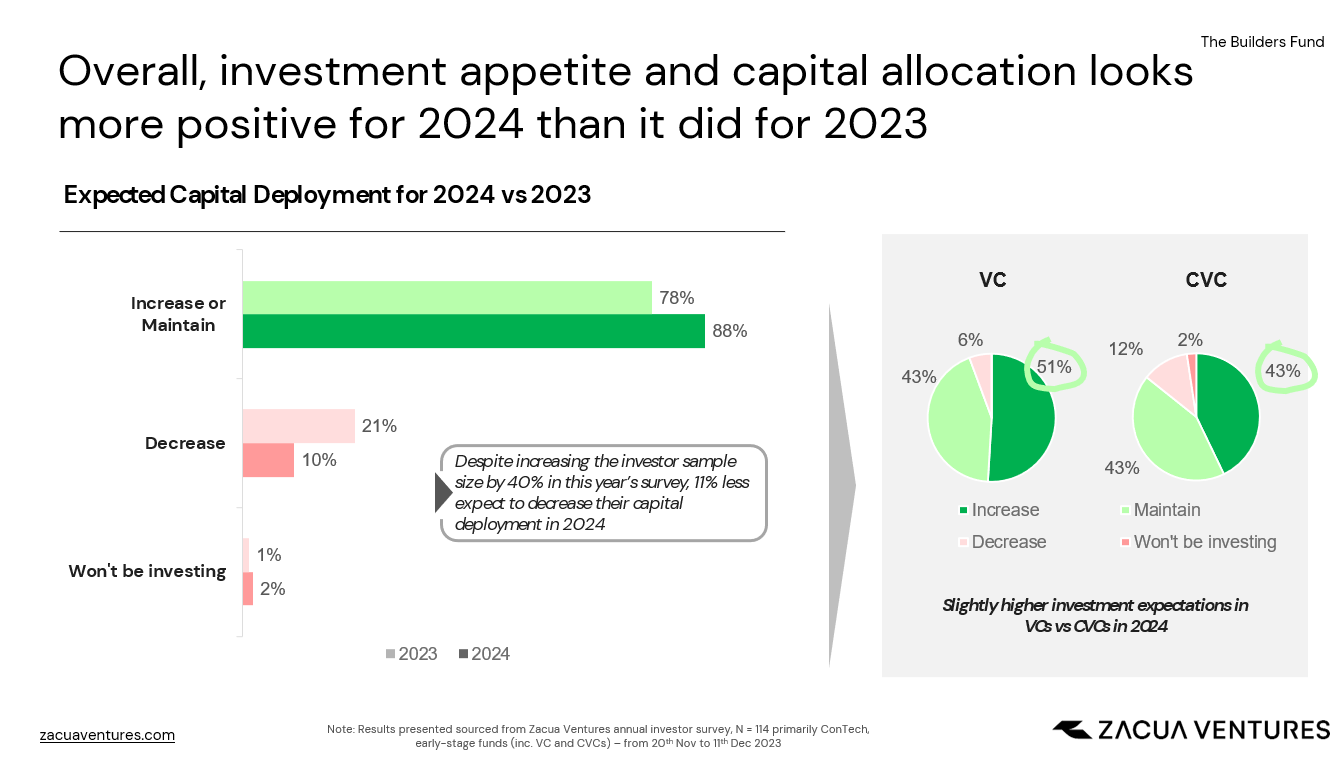

Positive investment appetite for 2024 compared to 2023:

Compared with our 2023 results, there’s a growth in the expectations to either maintain or increase capital deployment in 2024 (78% to 88% in 2023 and 2024), with the respective decrease (-11%) in the funds that are expecting to lower their capital deployment in 2024 compared to 2023. With 51% of respondents stating they’re looking to increase their investments in 2024, VCs are driving the positive investment appetite trend.

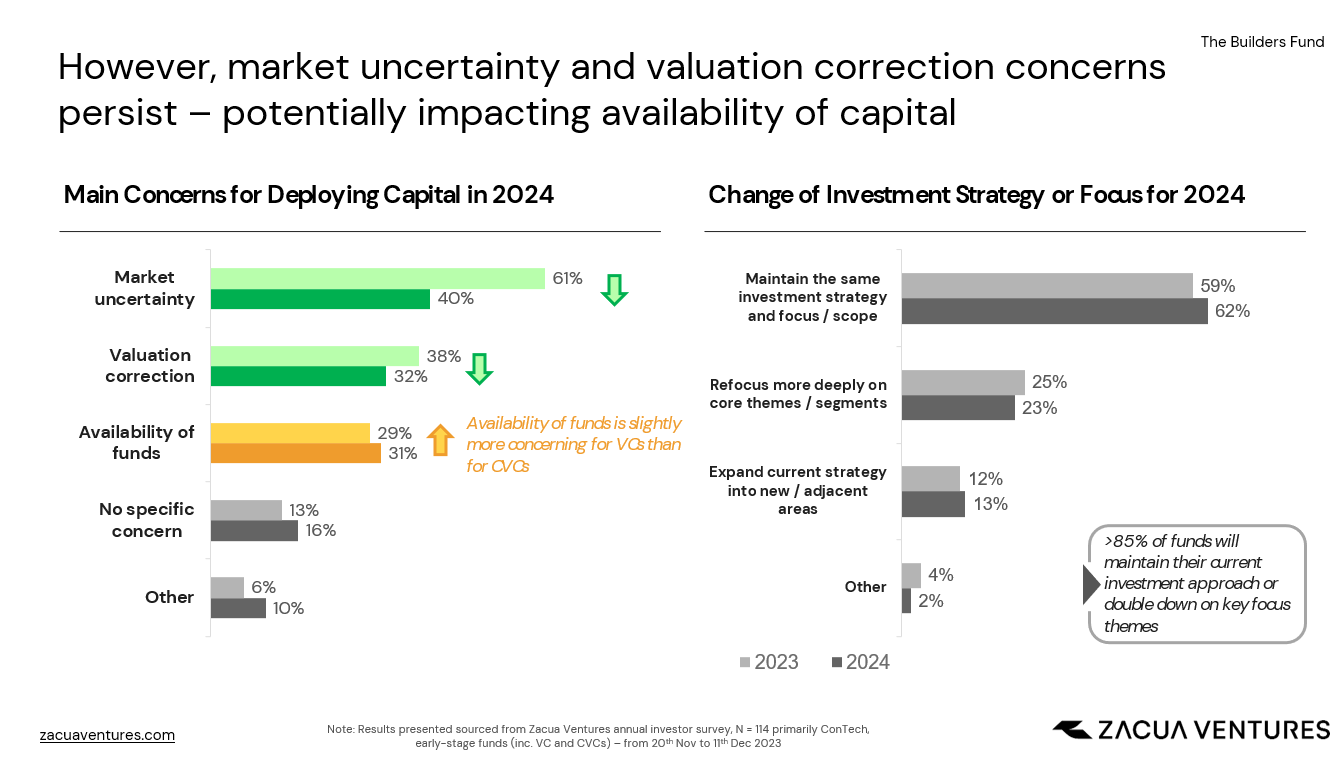

Macro concerns still persist:

Despite the expectation to increase investments in 2024, around a third of respondents still reported market uncertainty, valuation correction, and funds availability as challenges to deploying capital in 2024. However, this year seems to be bringing calmer waters to investors: this is reflected in the decrease in the top two concerns in 2023, Market uncertainty (61% vs 40% in 2023 and 2024) and valuation correction (38% vs 32%).

On the other hand, the only concern that has increased, albeit slightly, is ¨funds’ availability¨, which isn’t really surprising following one of the toughest years for fundraising in recent VC history. Related to this, some ¨other¨ answers pointed to concerns related to startup difficulties in raising subsequent rounds or forming a strong investment syndicate.

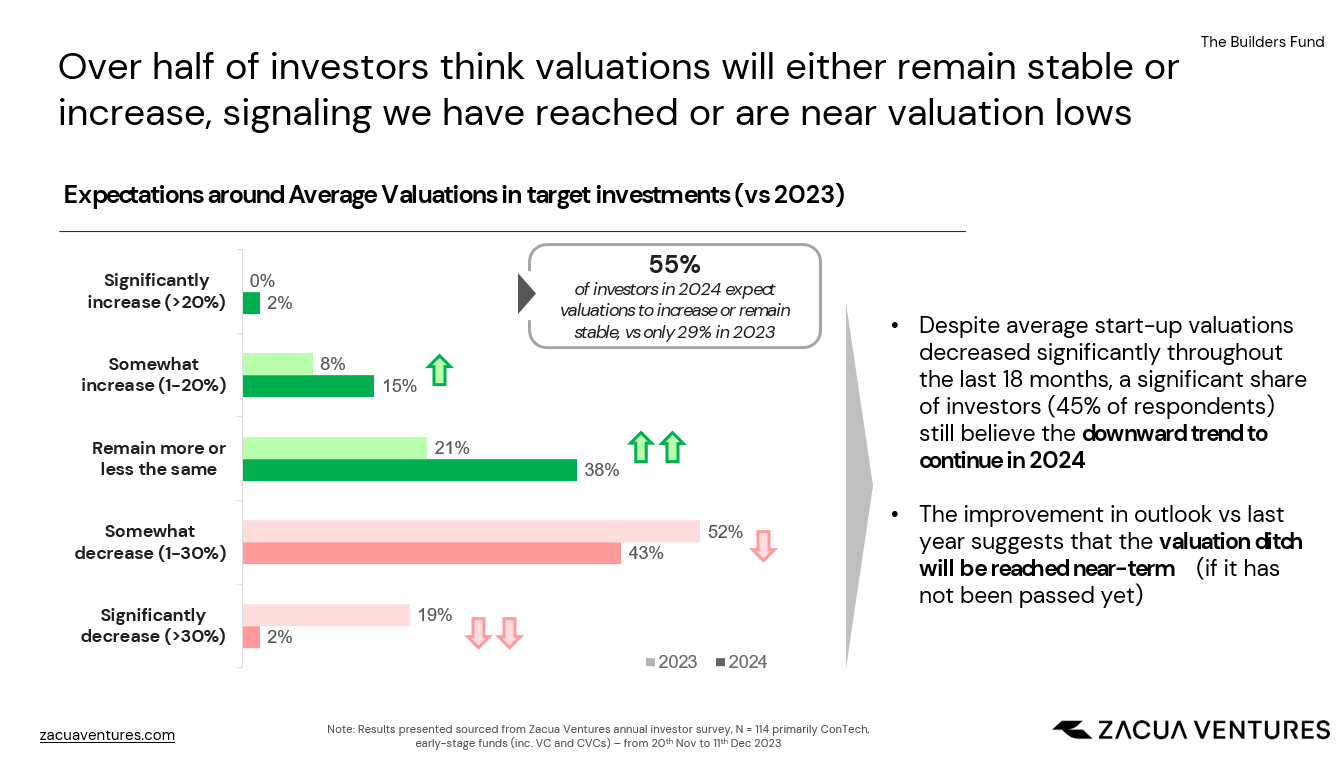

Valuations may still see a downward trend:

Even when the majority of investor respondents believe that valuations will either remain the same or see an increase in 2024, the single most chosen answer was an expected small decrease in valuations (up to 30%). Overall, the market is positive about valuation recovery, with a significant improvement from 2023, when roughly 70% of the investors expected a decrease.

This leaves us with the expectation that we may still see some further decline in valuations before hitting the floor and bouncing back to levels prior to 2023.

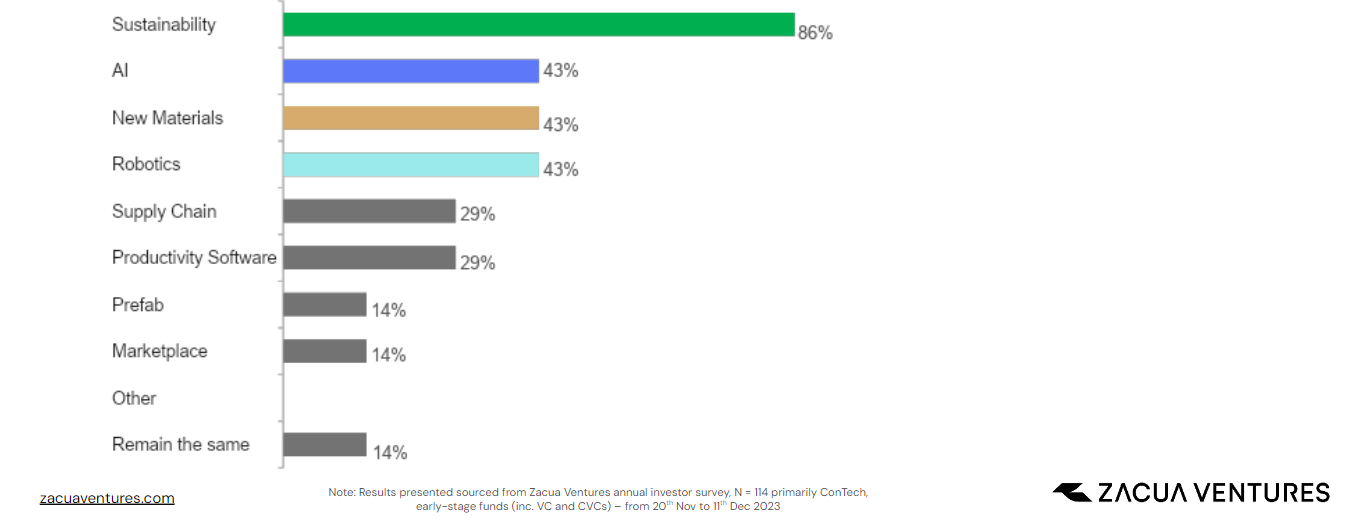

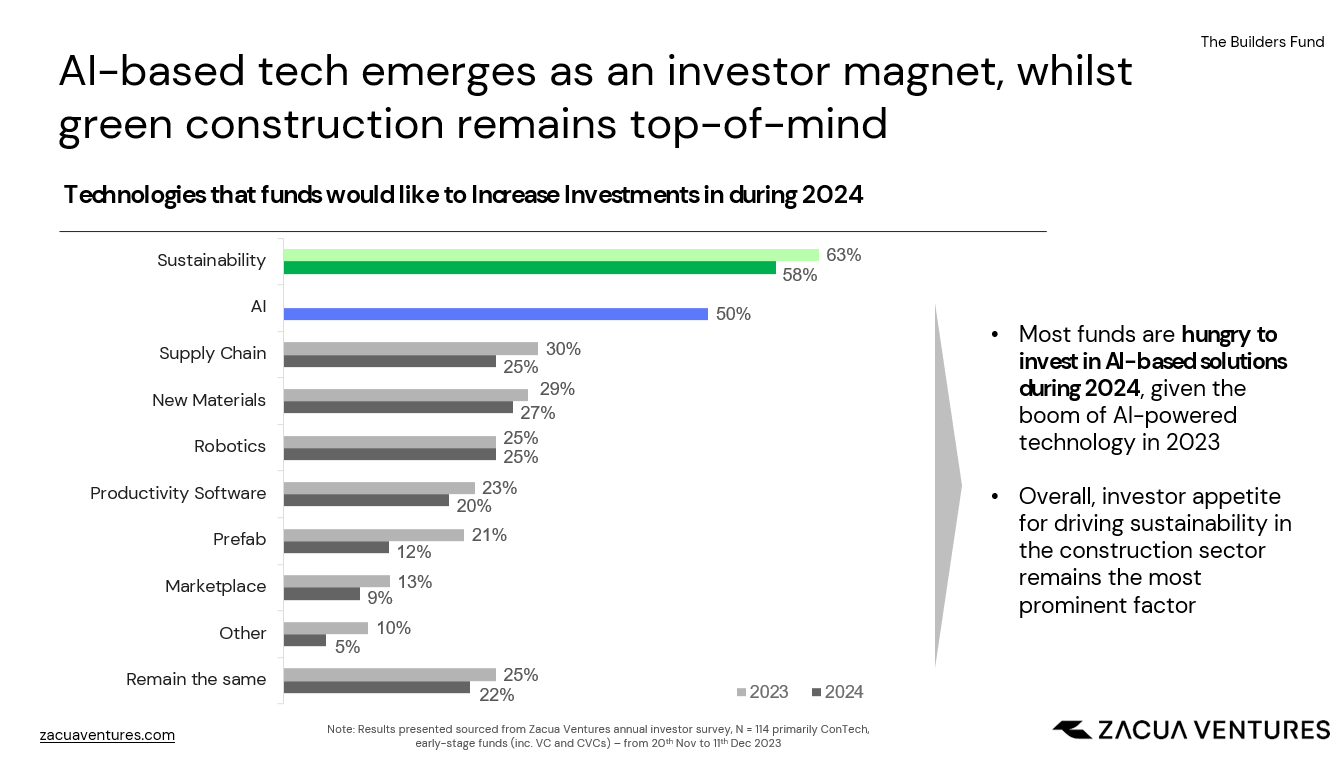

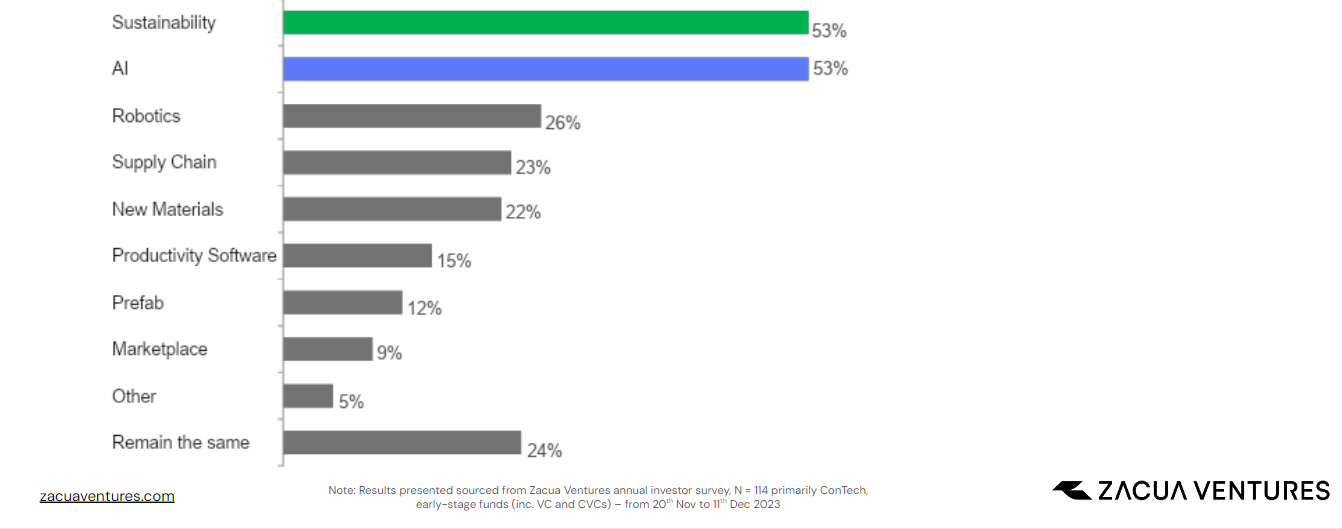

AI and Sustainability are on everyone’s minds:

More than half of respondents are looking to increase their investments in areas of AI and Sustainability, which is not a big surprise given the boom of AI in 2023 and the increased focus on sustainability driven by policymakers, corporate and customers ESG goals, followed by an increase in climate tech focused startups.

Other technologies haven’t seen a significant change compared to the answers we got in 2023: New Materials, Robotics and Supply Chain are areas receiving interesting attention from investors.

No surprises when considering key factors driving investments:

In spite of some minor changes in the answers, particularly in the increased interest in Traction and Differentiation and the decrease in Burn Rate, the key factors investors are considering for evaluating startups remain pretty similar to those ones in 2023.

We could argue that these are driven by the increase in solutions available in the market, which makes it harder to differentiate and evaluate their long term adoption, outside of some short term hypes.

FINAL THOUGHTS

Despite the tougher investment landscape we’ve seen in 2023, and a sharp decline in overall VC investments, Contech somehow bucked these trends, with data showing that the number of deals in contech in 2023 was similar (even slightly higher) to that in 2022. However, the total invested capital saw a decline, driven by lower amounts of late stage deals (final numbers are still being confirmed). We believe part of this was due to the fact the construction industry stayed resilient and kept growing despite major challenges like inflation, rising interest rates and skilled labor shortages, pushing for more deployment of new technologies on site.

Construction is a lagging industry, so backlogs of projects were carried into 2023, but not a lot of new work was launched in 2023 in certain areas (like residential), so that will show up in 2024. A lower adoption in these projects may push startups for a shift towards civil, infrastructure and industrial works, or a focus in new regions with big development projects.

A relatively high level of concern for deploying capital, paired with some expectations of lower valuations, may pose a tough fundraising landscape for startups in 2024, but we’re expecting that the situation sees a rebound sometime in the year (assuming a steady geopolitical climate), as investors’ confidence and dry powder grows. The steady peace of early stage deals will bring to 2024 much more late-stage opportunities, which should, in turn, positively impact the total amount of capital invested in the industry.

As usual, startups developing technologies with a sustainability focus or an AI component may be the exception to this tougher fundraising environment and valuation correction. We’re still recommending startups in our portfolio to prioritize sustainable growth and a healthy burn to sales ratio.

Regional differences will persist, with the US continuing to represent 50% of Contech investments. However, we believe that the growth rate in new investments will be higher in developing economies, particularly Asia (India & SE Asia in particular), Middle East and LatAm, in which the industry shows higher growth rates, and the companies are starting (or accelerating) their tech adoption path.

Finally, we’re expecting CVCs to become more active in the investment landscape, following a general trend in the VC industry. This may result in some tailwinds in the market, particularly in an increased backing in deep techs (robotics, new materials, industrial tech) at the early stages, providing strategic support in product development in early TRL startups, where VCs may be more hesitant to deploy significant capital.

Many thanks to everyone who has participated in the survey and in our analysis! As always, we’re happy to discuss and hear your thoughts – please reach out to us if you’d like to chat.

Answers by segments

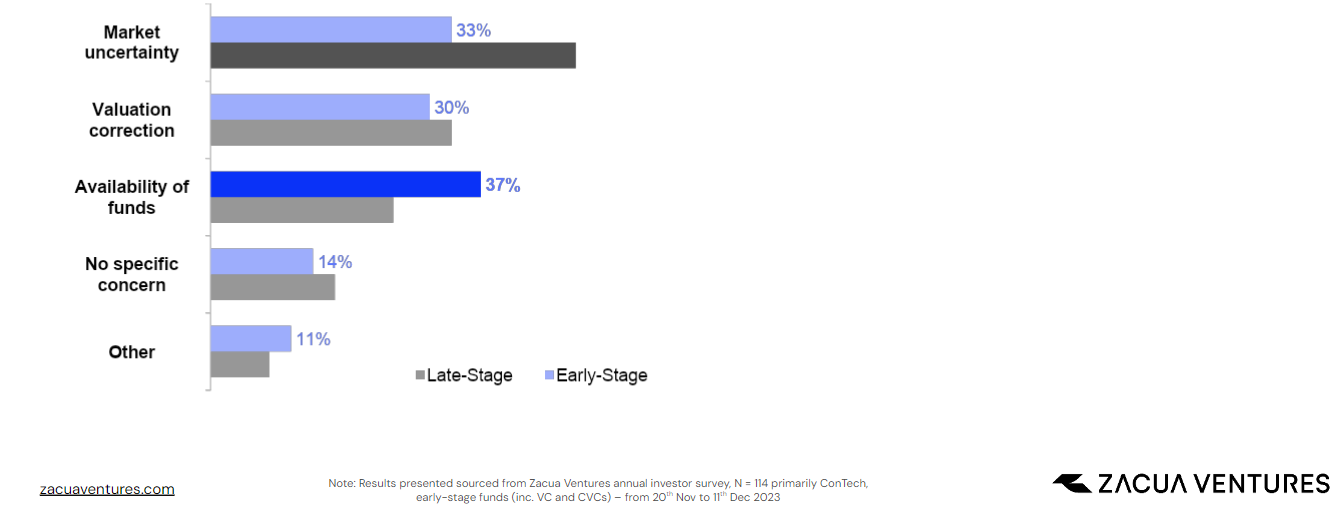

Pre-seed & Seed investors Vs Series A/B: When segmenting by stage of investment we have encountered interesting differences worth mentioning:

- Higher willingness to increase investment by later stage investors: 10 basis points of difference between the investors in this answer (48%) against early stage ones (38%).

- Early stage investors show less intention to change their investment focus: 70% of respondents will maintain their focus, against 52% of later stage ones, which showed higher answers in both refocusing more on their core themes and expanding their focus.

- Market uncertainty is the highest concern for later stage investors (50%), while funds availability is the primary one for early stage investors (37%)

- Valuations show a more pessimistic environment in Series A/B, with 52% of answers expecting to either decrease or significantly decrease and only 12,5% of them thinking they will increase. In early stages, on the other hand, 41% of answers expect valuations to decrease vs 19% expecting to increase or significantly increase.

- ¨Team¨ and ¨differentiation¨ are the biggest investment criterias in early stages, compared to ¨traction¨ and then ¨team¨ for series A. Almost 40% of the later stage investors affirm that ¨burn rate¨ is among their key metrics, twice more than early stage ones.

Geographical segmentation

When filtering the answers by geographical scope, we find interesting differences in the regions, which follows general trends we’re seeing in the construction industry overall. Keep in mind these answers aren’t tied to just one region because funds like to spread their investments around different areas.

- North America: With NA accounting for more than 50% of the total Contech investment in 2023, half of the funds investing here are looking to maintain their investment peace in 2023. This is the only region in which AI places first in attractiveness, together with sustainability.

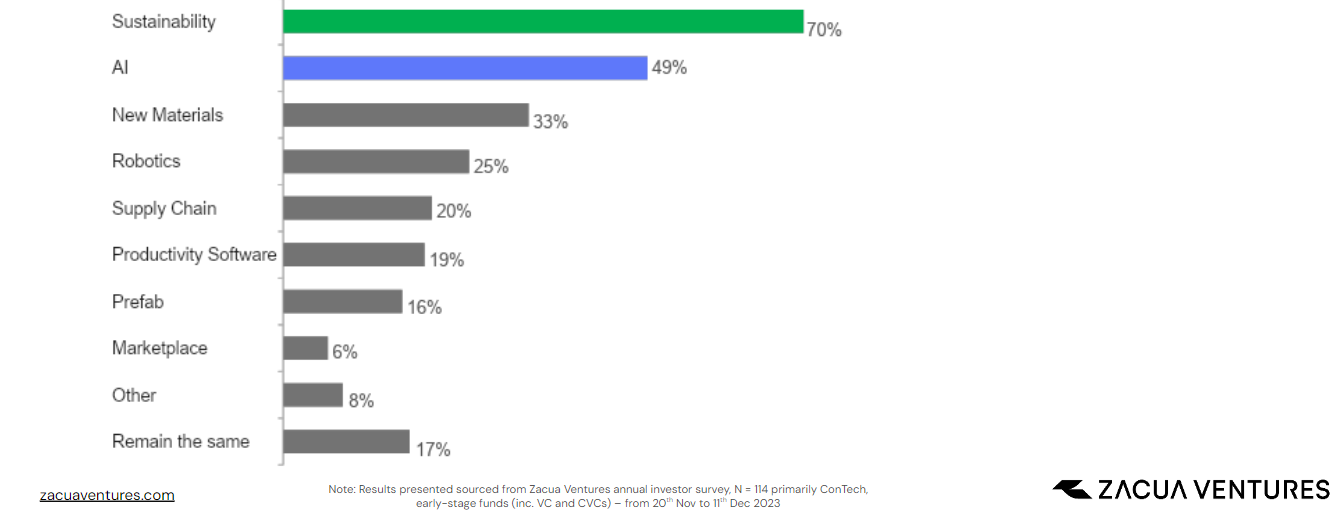

- Europe: We may expect a slow improvement in the fundraising environment in the region, with 46% of the funds willing to increase their investments. Increased concern in sustainability makes this category the preferred one for investors, with 70% of answers looking to increase their exposure in the area.

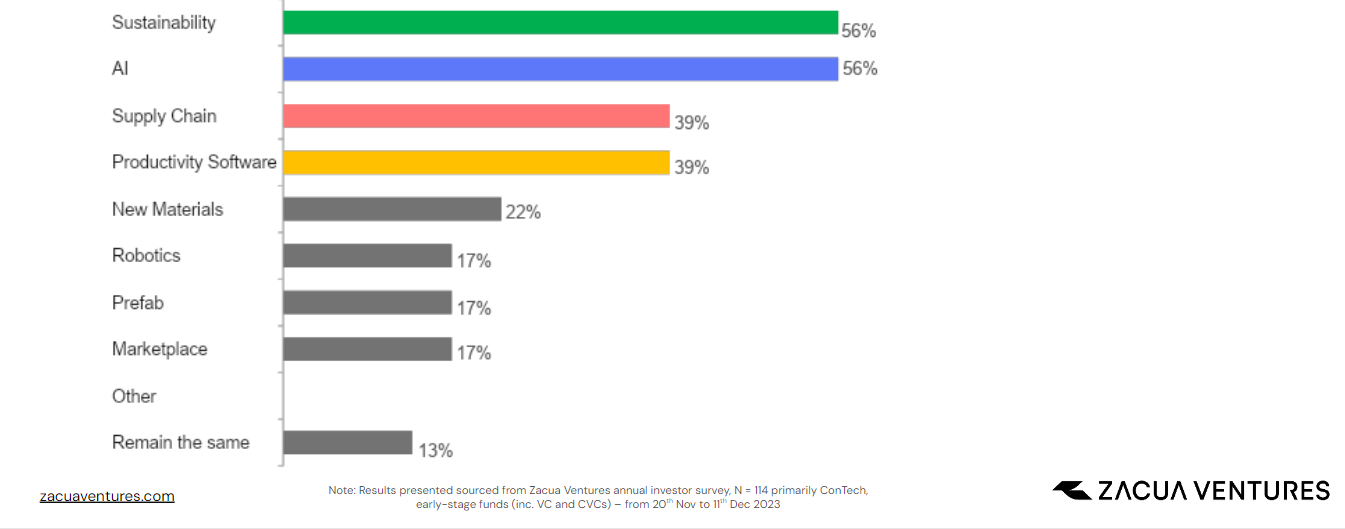

- LatAm: Despite continuous geopolitical challenges the region faces, more than half of the investors of this region are willing to increase their investments (56%), and they are looking to do it in wider variety of areas, including ¨productivity / field software¨ and ¨Supply Chain¨ within their top priorities (right after AI and Sustainability).

- Asia: Placed at the same level as Europe in their investment expectations, the region stands out by its focus on Robotics, where almost half of the investors showed interest in increasing investments in the area. However, this area is still behind ¨sustainability¨ (70%) and AI (60%).

- Middle East: with an astonishing 70% of the funds in the region willing to increase their investments and 85% willing to do so in the sustainability space, we can expect the region to welcome a lot more of green tech startups to take advantage of the opportunities arising from a growing industry, particularly within the mega projects that have strong green KPIs.