- M&A context & market dynamics

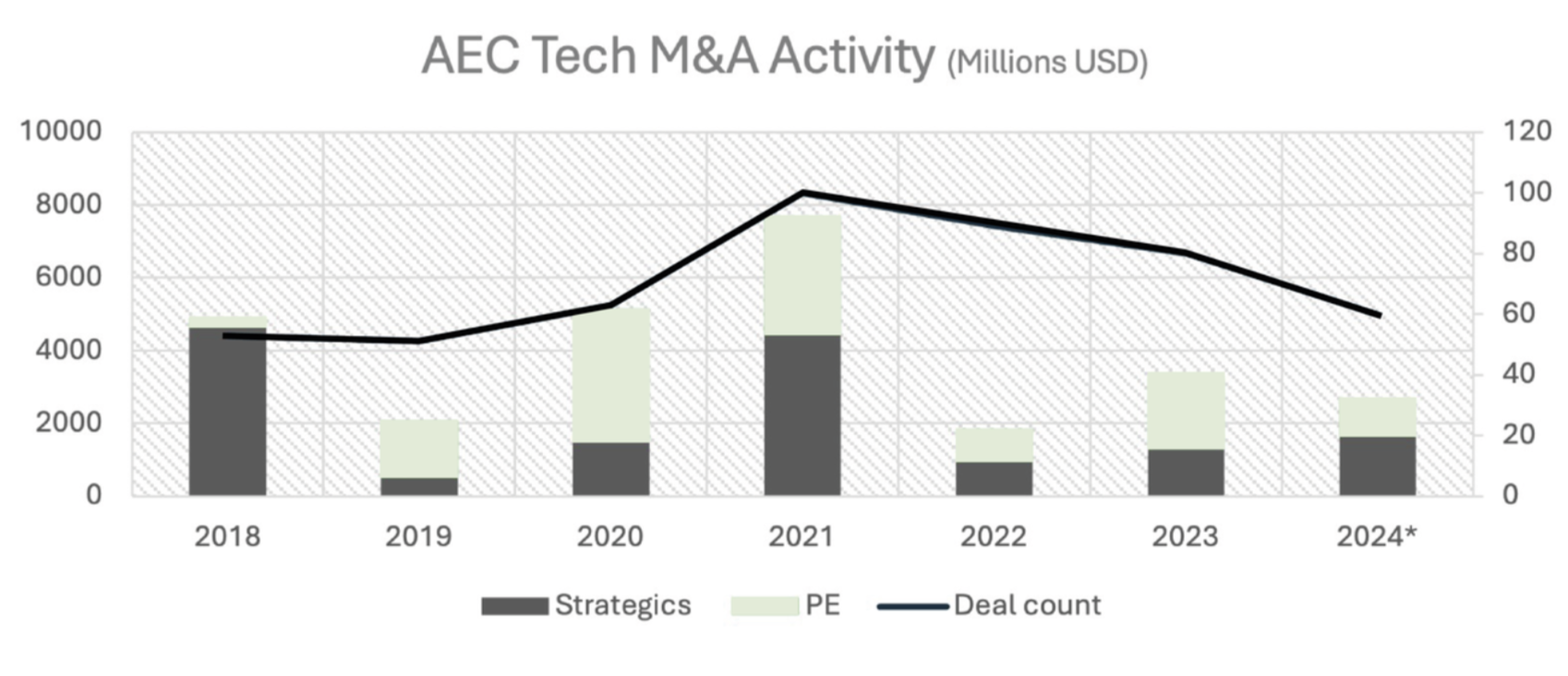

The construction tech industry has witnessed a notable increase in M&A over the past few years. This activity is mainly driven by the increased digitization in the industry and the huge fragmentation in solutions, giving the opportunity to established companies and PE firms to consolidate the market and broaden their product offerings in this fast-growing Contech market.

Source: Piper-Sandler – *2024 values are annualized.

This trend is in line to what’s happening in the broader AEC industry, which has seen a robust resurgence in merger and acquisition activity recently, where ¨Firms are also focusing on acquiring technological capabilities to enhance project efficiency and client outcomes, specially in the areas of AI, BIM and advanced analytics¨ (more info here).

TOP 3 Comments

¨There’s a lot of movements and all kind of deals going on. We’re seeing one new deal every week, small deals, PE led primarily. Strategics are also very active, though most of the acquisitions aren’t being announced¨. Head of M&A Top 10 M&A Strategic

¨M&A compares to previous years. 2023 saw many more deals since the market changed a lot. That has somehow stopped now. Companies that survived are in better mode. We’re seeing less deals but higher quality companies¨ M&A Director

¨Dealflow is still coming through. We’re seeing less quantity than we saw before: companies like Rhumbix and Assignar, that raised a lot of money but struggled after since the market got saturated of solutions and incumbents have take off. There’s a lot of consolitation going on. It will be interesting to see which segments represents the next opportunities¨ M&A Director

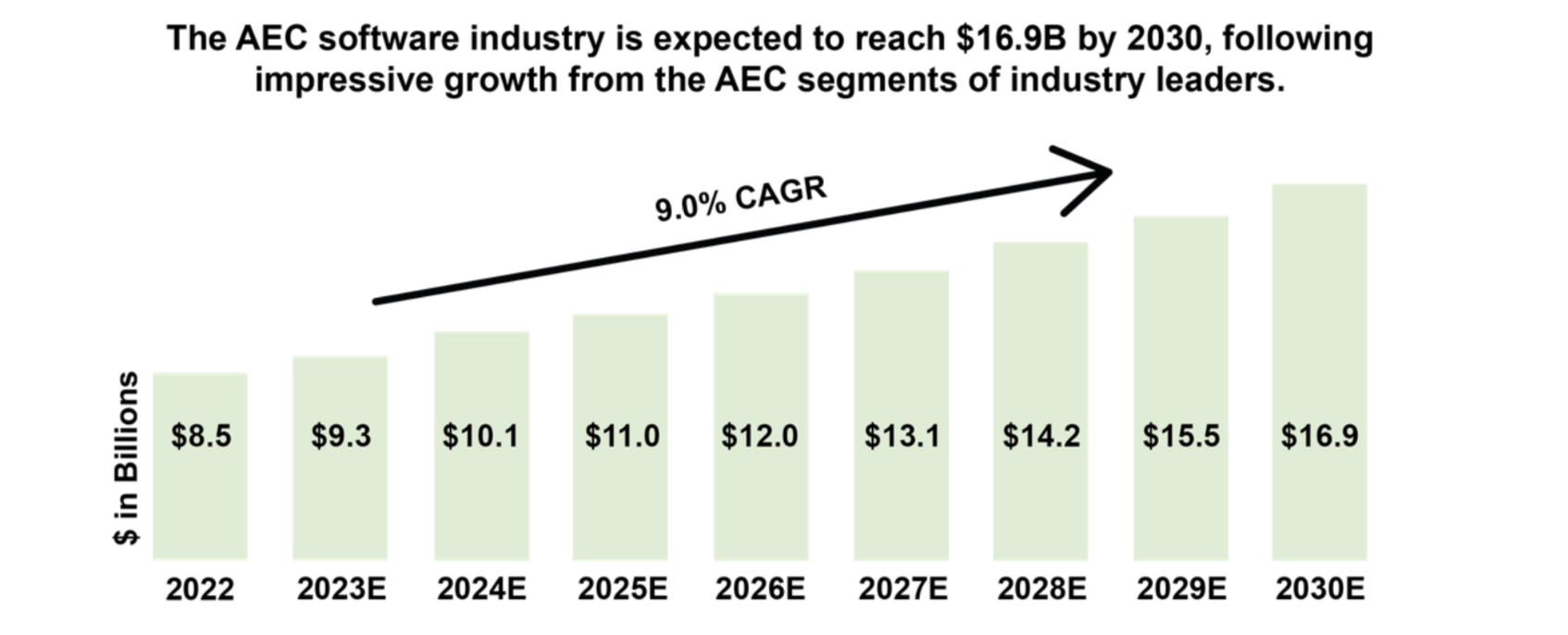

The AEC software industry is expected to reach $17Bn by 2030 (some analysis even place it at that size today), following impressive growth from AEC industry and an expected increase in the percentage of revenue invested in IT driven by the need of digital transformation and the increased challenges in project complexity, sustainability requirements and labor shortages.

Market massive opportunity

Source: Software Capital

Source: Software Capital

Since we started investing in construction tech, back in 2017, we witnessed an impressive surge in digitization and adoption of technologies by construction companies (for detailed info, check this report). But it wasn’t until 2019 that we started realizing about one emerging trend that, in our opinion, is key to define a large portion of today’s M&A market in Contech: The creation of Digital Platforms.

¨Digital Platforms¨: software solutions that centralises data from different sources and allows information flow in different directions:

- Horizontally: Data flow across the different stages of the projects:

- Design – Construction – Operation

- Vertically: Connecting the diverse stakeholders involved in a project

- Project Owner – General contractor – Subcontractor – Supplier

- Project Owner – General contractor – Subcontractor – Supplier

- Diagonally: Integrating data from different software’s being used by the same stakeholder.

- Procore Marketplace / Autodesk Construction Cloud

The platform strategy is the response of large acquirers to respond to the key market trends that are driving the increase in M&A activity in the space:

Resilient industry with Increased demand for tech solutions

As the industry has traditionally been slow in adopting new techs, a growing demand in digitization to achieve higher efficiency and productivity is pushing core solutions (ERP / PMs) to expand / complement their product offerings to quickly enhance their technology stacks. M&A activity can help streamline the adoption of solutions as long as they’re attached to the customer’s core tech stack.

¨Majority of contractors still run their businesses primarily through their ERPs (and in most cases, it is the only software they use. A clear strategy for us is to anchor our ERP and add on multiple capabilities on top of it¨ – M&A Director in top 10 acquirer

The surge of point solutions (market fragmentation)

The increase in tech has given birth to a wide number of very specialized solutions, solving a very specific problem. These specialized solutions often address specific pain points within the construction process but lack the breadth to cover the entire project lifecycle. Large companies (¨Strategics¨) are acquiring these specialized startups to integrate their unique capabilities into broader, end-to-end solutions, offering an end-to-end solution across project lifecycle.

Cloud computing, mobile first and SaaS models

Real time collaboration, site access and scalability provided by ConTech startups shifted the peace of tech adoption in many construction companies, making these startups an attractive acquisition target for more established, legacy software companies.

Increased value of AI, data and analytics

The growing value of data we’ve seen as a result of the increased digitization in the industry is driving acquisitions of startups specializing in these areas. By integrating AI and analytics into their platforms, established construction software companies can radically increased their value prop leveraging the vast amount of data they control.

Fragmented industry, with 98% of companies being SMEs

Industry fragmentation, paired with the fact that it is still a project-based industry create a complex environment for scaling technologies. An efficient Go-To-Market strategy to efficiently access a large pool of contractors is key for success.

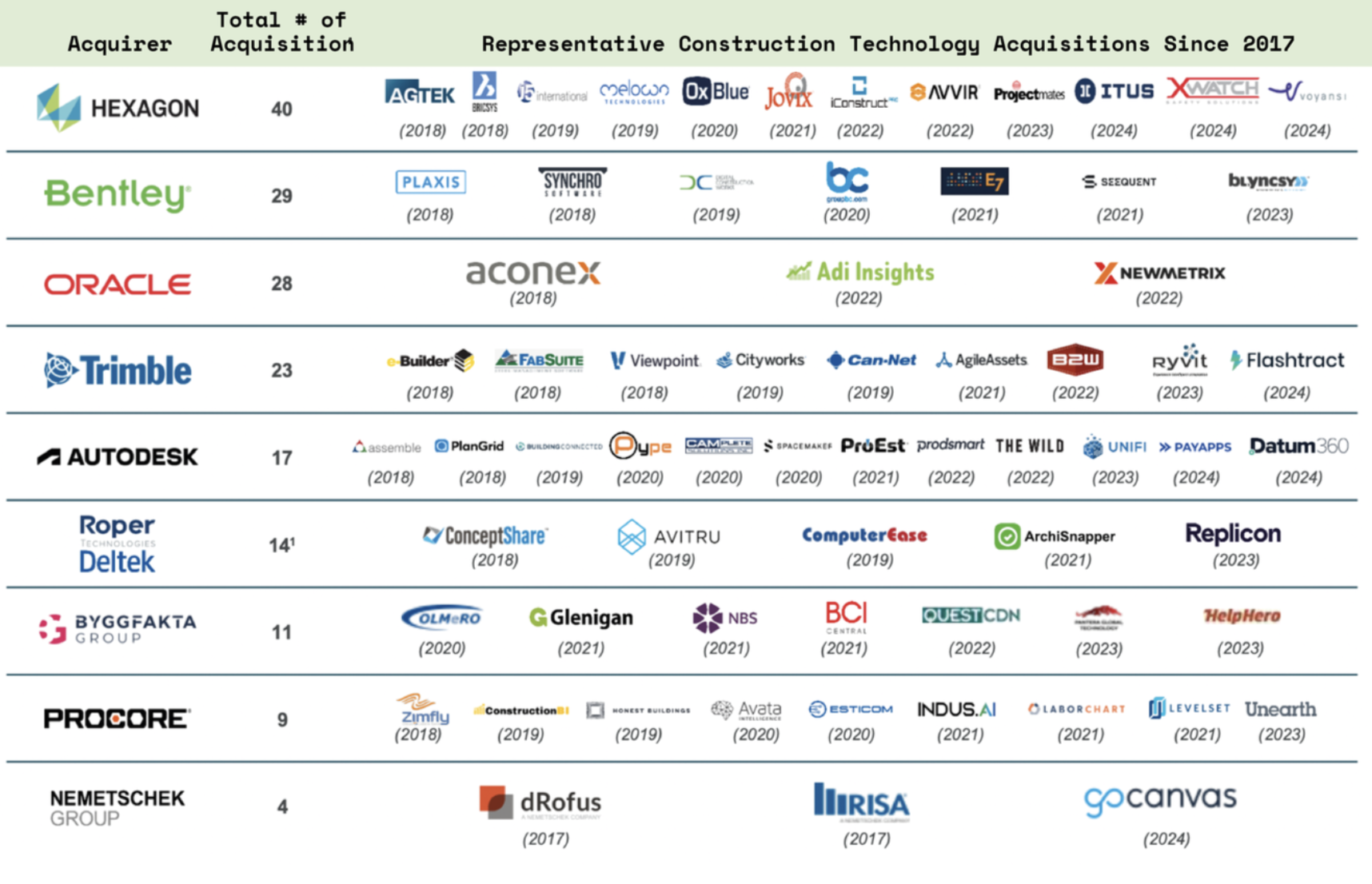

2.Strategics M&A landscape

Piper-Sandler M&A analysis, 2017 to Jul 2024

Piper-Sandler M&A analysis, 2017 to Jul 2024

Strategics continue to consolidate the Contech landscape, with over 175 public M&A coming from the top 10 strategic players since 2017. Given the context in the industry and the key market dynamics, they are best suited to take advantage of the M&A context, providing the startups with unique resources, such as:

- Leverage GTM and access to customers.

- Lower CAC and improved unit economics.

- Improved product stickiness with deep integrations with core systems (primarily ERPs).

- Complement product capabilities with other that potentiate the value perceived.

- Improved customers data access, combining them for better project analytics.

¨In May 2024 we acquired an early stage startup, within 3 months we had already doubled their revenues¨ – M&A Director in one of the top 10 acquirers

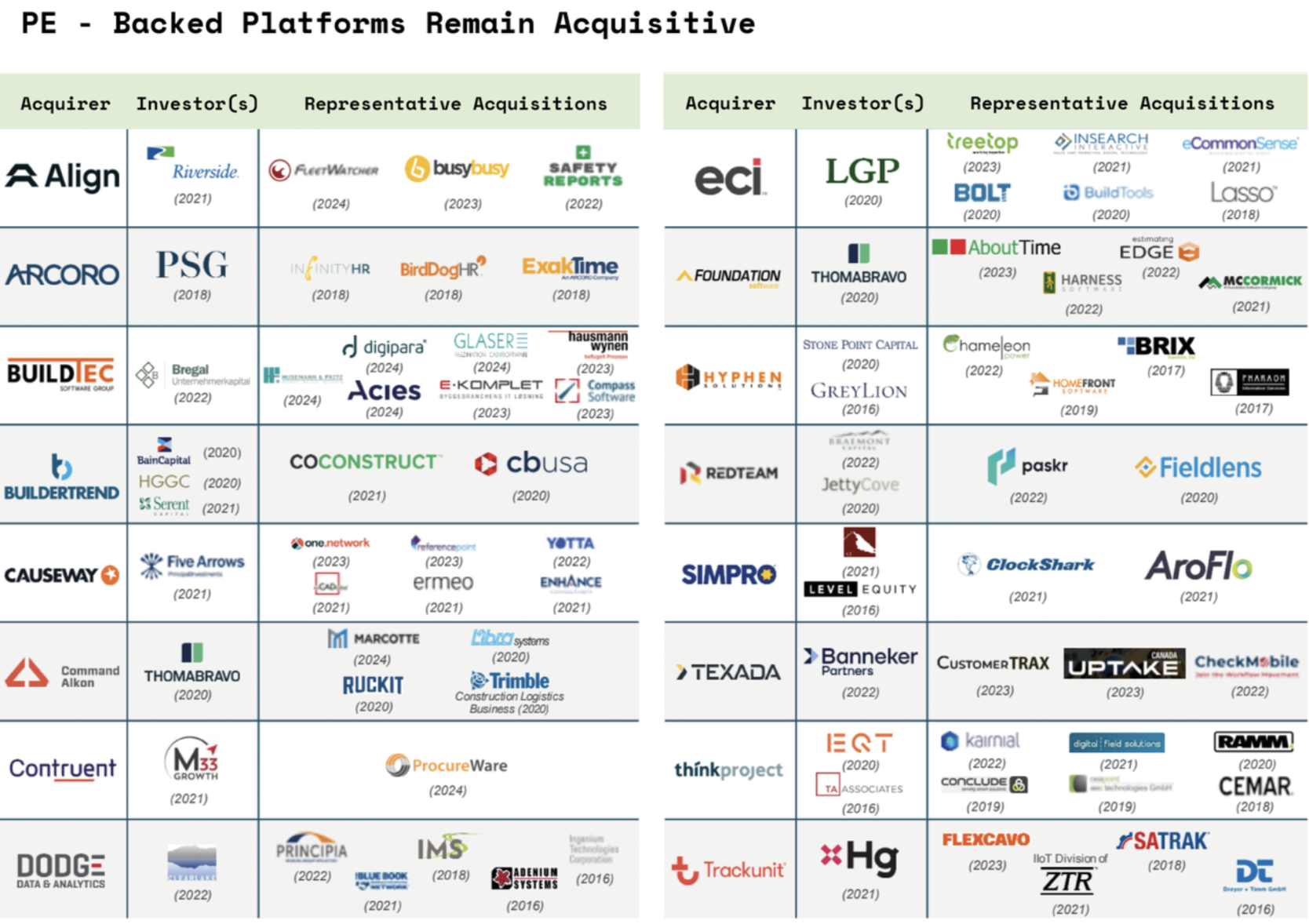

3.Private Equity activity

Piper-Sandler M&A analysis, 2017 to Jul 2024

Piper-Sandler M&A analysis, 2017 to Jul 2024

Private Equity interest remains high and gained momentum in 2023, with a very similar strategy, acquiring the base software stack to leverage its stickiness and customer base to then do smaller, strategic acquisitions that complement the product offering.

PEs are well capitalized and getting more active in industrial software, which has shown higher multiples and stock performance than the average enterprise software.

Thoma Bravo acquired Foundation software, an ERP software for small and mid size subcontractors in May 2020. The company was founded in 1988 and was still family owned. Its target customers were mid-sized contractors, and it offered two basic producs: an ERP system and a payroll solution.

By the time of the acquisition, Foundation had $50M ARR, 5.000 customers and less than $10M in EBITDA.

In three and a half years, Thoma took the company to $150M ARR, 45% EBITDA and a suite of 8 different products across 12.000 customers.

Clearly, not all this growth happened organically. Foundation made four acquisitions since, in different product categories (HR, time management, estimation and safety) tailored to the same customer typology:

¨We’re creating a full suite of products any subcontractor would need to run their business. The AEC software market is very fragmented, with a lot of small player tackling niche solutions. This bring a great opportunity for PE to consolidate market. The 4 acquisitions we made from Foundation were In different product categories, with the idea of integrate them and bring different capabilities to their product suite.

Moving forward we see a lot of potential in payments and field service application. We will continue to acquire new capabilities that we don’t want to build internally or we want to bring fast to the market. ¨. TB Podcast

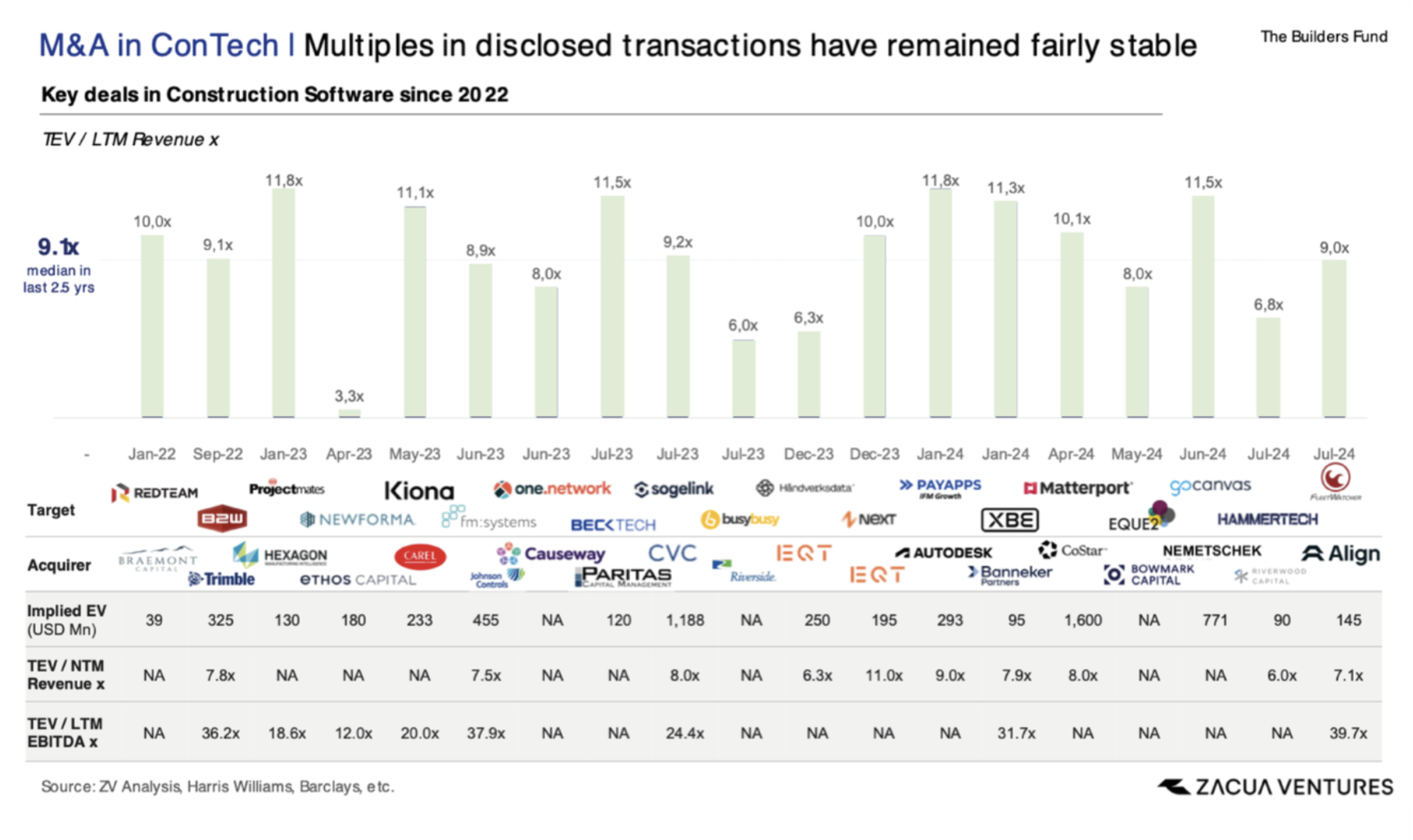

4.Market multiples

It’s not easy to determine what’s happening with multiples overal, primarily since majority of the transactions that occurred in 2023 and 2024 went under the radar or with undisclosed amount. As we mentioned before, most of these undisclosed transactions were made on reasonably good companies that didn’t manage to raise further funds or tackle an efficient GTM, so we’re not expecting these to represent the standard M&A operation multiples. Disclosed M&A transactions however showed a growing multiple this year compared to the previous one, but still lower than the average in peak years (2021 & 2022). What we haven’t seen in these past years were outstanding operations with multiples over 12x LTM ARR, which were more common in 2021 (Seequent 16x, Levelset 15.1x, Fieldwire 13x, etc), signs of a still conservative market.

Nevertheless, if we compare AEC tech multiples against general software multiples, we find that Contech trades at an interesting premium: while the software industry averages 6.9x LTM ARR, the median since 2022 for construction tech acquisitions has been 9.1x. This trend follows a consistent pattern since Covid, when ¨Industrial software became the most valuable software sub-sector due to the massive digitization opportunity across the ¨Real Economy¨, resulting in a once in a lifetime opportunity to invest in this category¨ Evercore M&A Report Jul 2024.

In summary, with the information we have gathered on disclosed and undisclosed transactions, we can estimate that the market average is between 9 and 11 times revenue (LTM), where fast growing companies can go up to +12x and slow growing or distressed companies are in the 3 to 5 times multiples. If you ask Strategics, they woud tell you their sweet spot is 5 to 10 times revenue multiples, beyond this are only exceptions.

5.(Initial) Conclusions

Lack of M&A is an issue of Supply, not Demand.

We heard this repeated times: there’s not enough new techs companies above $10M ARR, and even less if the target is above $50M ARR (most of these companies are heavy capitalized by a PE or a large VC). Strategics suffer the most this lack of M&A opportunities, as they’re often outcompeted by their PE peers in the few available deals. Would a push for the next gen Contechs above $10M ARR drive prices upwards?

Product matters, revenue & growth sets the price

Unless we’re talking about a stand-alone platform, what acquirers really care about is finding the right product that complements their existing software stack. Growth is important, but not that important when it comes to selecting their M&A targets (they’re confident their key value will be potentiating the target GTM and customer access). However, growth rate is what defines if the target will be closer to the 3-5x revenue multiple, on the higher end of 9-11x, or anywhere in between.

Integrations pave the way

Particularly true in cases of early-stage M&A (<$5M ARR) in which product-market fit isn’t that obvious for outsiders, having integrations with potential acquirers can define an M&A target, proving there’s actual synergy with other software. We’re clearly not talking about the desire M&A outcome of a fast growing startup, but if sales aren’t growing as expected or the startup is struggling to raise its financing round, a close working relationship with a Strategic could define its outcome. In more mature startups, it may not define the target, but it clearly sets them on the eyesbull of the acquirer.

What about hardware?

Yes, we know we have only covered the software part of M&A, and Contech covers much more than that. Luckily, we’re seeing that business model creativity is bringing recurring revenues and scalability in technologies such as robotics, new materials, etc.

¨Hardware doesn’t have the stickiness of software, but there’s a very interesting space in the intersection of Hardware and Software, that’s an area we will invest more¨. M&A Director in one of the top 10 acquirers

Nevertheless, valuation follows different criteria, providing higher weight to IP and technology (to the point of seeing some M&A activity in pre-revenue companies). Moreover, it called our attention that other parameters such as ESG and carbon credits could be important drivers for target selection and valuation increase/decrease.

This is the end of the first part of our M&A analysis. There’s a LOT more data to be presented, and more interviews are coming to really understand how to evaluate the M&A landscape and how to better position your startup and investments for a successful exit. If you’re active in the M&A space of you can connect us with the right people, we appreaciate any introductions.