👋 this is Zacua Ventures! We’ll talk about what excites us around Construction Tech, Sustainability, Productivity and Urbanization solutions for the Built Environment; any suggestions on topics that could be of interest are welcome. Also we’re very open for feedback, and make sure you follow us on LinkedIn and check our website for the latest updates!

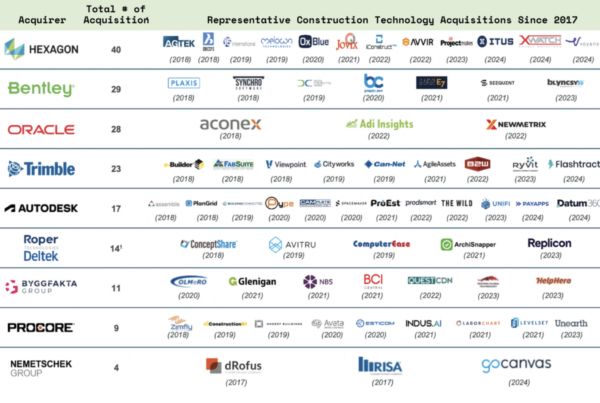

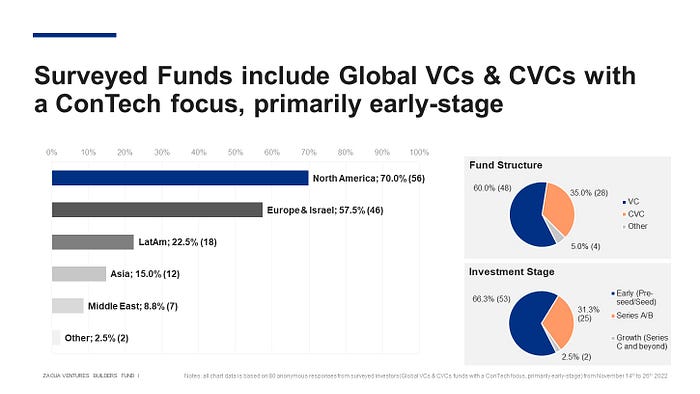

Last November we conducted a global survey to test the Investment Climate for 2023 on funds that have Contech as, at least, one of their investment verticals, and we collected responses from 80 funds!

Below the Key Survey Insights and our Takeaways.

Key Survey Insights:

- Overall, expected capital allocations for 2023 are fairly positive, primarily among VCs, who seem to be sitting on a lot of dry powder. We’re seeing, however, a bit more skepticism from CVCs, whose investment capacity is usually more dependent on the company’s budget and overall performance

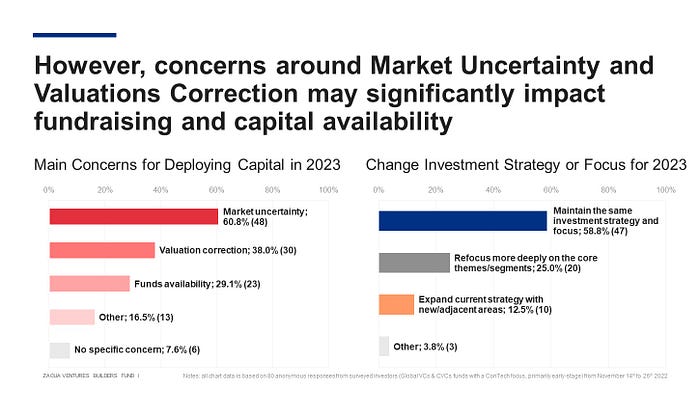

- As expected, the main concerns for deploying capital in 2023 are driven by the market conditions: high uncertainty, correction in valuation and overall availability of funds

- Moreover, we’re seeing that 25% of the funds will refocus their investment strategy on their core themes/segments, which may increase the difficulties in fundraising of startups located in non-core regions (outside US for example) and non-core industries (which could be Construction for generalists VCs)

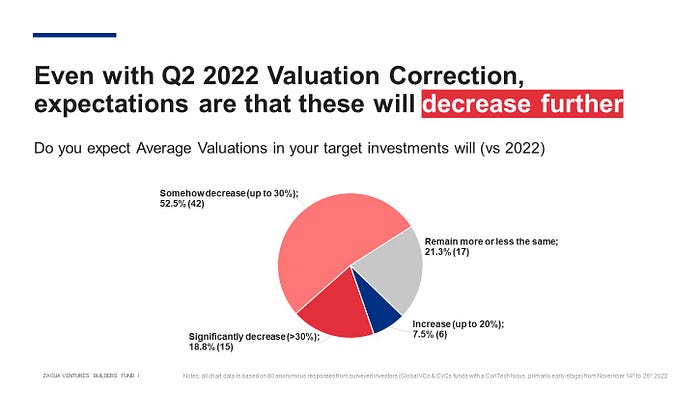

- Despite the downtick in valuations in 2022, expectations are highly inclined towards the continued decline in 2023, even above 30% in some cases. These expectations could be translated to funds holding off investment decisions until they see that valuation correction happening

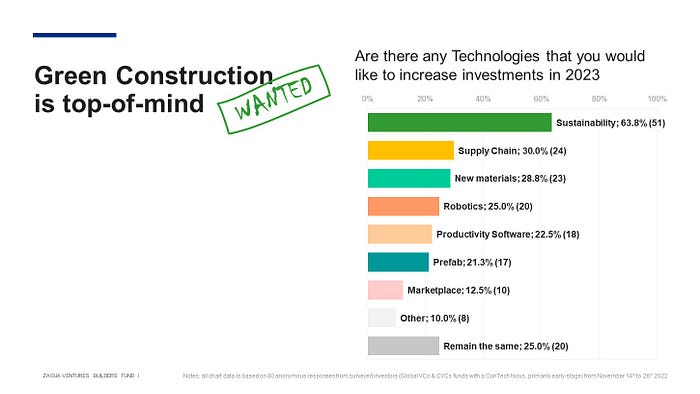

- An astonishing 64% of the funds are expecting to boost their investments in sustainability (80% if we only consider CVCs), which shows the results of the increased pressure from regulators, investors and communities. Some areas that also caught our attention are New Materials and Robotics, which haven’t seen much traction until recently, primarily driven by the low degree of maturity of these technologies or regulatory burdens

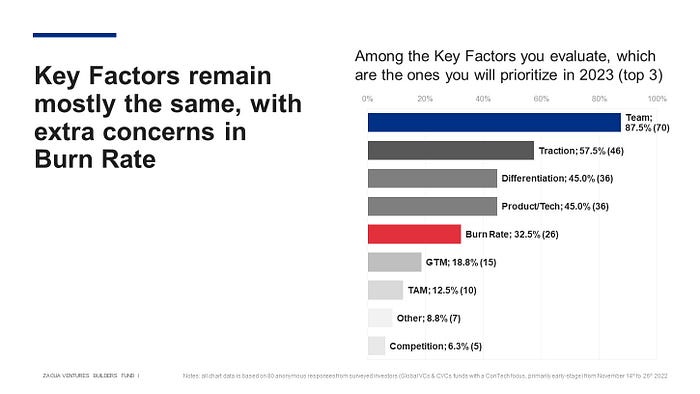

- No real surprises on the key metrics funds are considering. However, it caught our attention that Burn Rate has been selected by a fourth of the funds as one of them, which relates with the current expectations of increased difficulties in fundraising in 2023, therefore, the need to extend the runway

Final Thoughts:

As a result, we foresee 2023 as a great year for investing in the Contech space, since the adoption of technologies isn’t slowing down, we’re actually seeing an overall increase as an answer to the complex market dynamics like inflation, labor shortages and sustainability pressure, but valuations have (and most likely will) corrected to healthier multiples.

Due to these expectations, however, we believe that startups that need to raise in the initial part of 2023 will see the hardest hit in their desired valuations, hence the recommendation to focus on keeping burn low and extend runaway. There will be some exceptions to this, like startups acting in the sustainability space, which shows clear tailwinds due to increased market awareness. Startups acting in VCs peripheral geographical areas may face even harder times to conclude their fundraising activities.

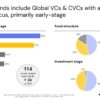

Finally, as a consequence of the tougher fundraising environment, we’re expecting some consolidation in crowded and very competitive areas, where more mature players will benefit from acquiring promising technologies in stress.

Thanks to everyone who participated in the survey, and excited to have all of you participating for next year!