The future of ConTech investments: insights from the 2025 investor survey

2024 marked a dynamic period for the construction industry and ConTech investments. The industry demonstrated resilience in a challenging global environment, with notable performance driven by infrastructure growth and advances in technology adoption. However, key challenges such as geopolitical instability, high-interest rates, rising costs, and constrained budgets presented obstacles for tech investors. Overall, VC investments showed a moderate increase compared to previous years, and Construction Tech, in particular, demonstrated significant growth, setting a robust foundation for 2025.

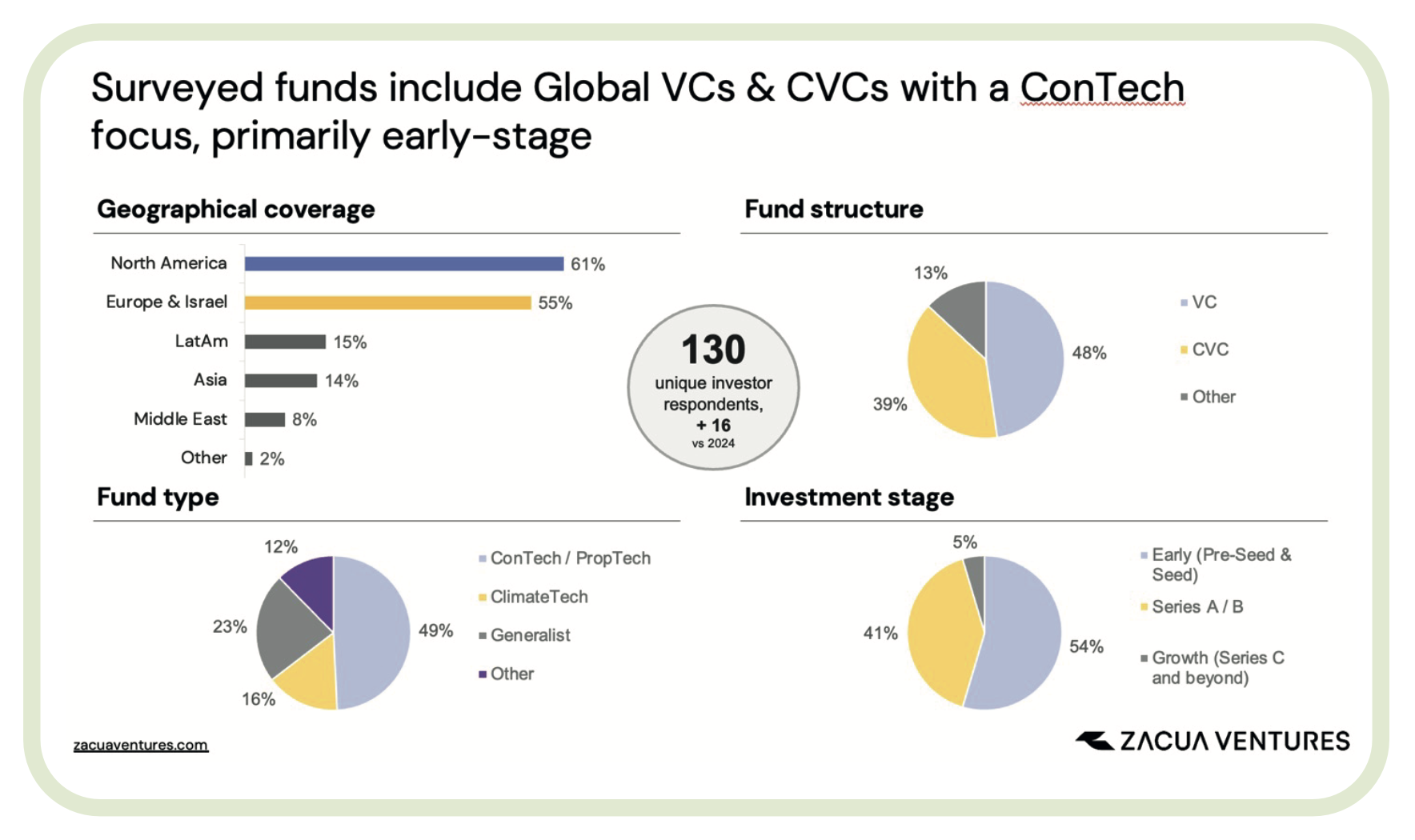

Building on this context, the 2025 ConTech Investor Survey included perspectives and expectations from 130 unique investors. The surveyed group comprised venture capital funds (VCs) and corporate venture capital funds (CVCs) primarily focused on early-stage construction technology (ConTech) investments with a global investment scope.

The survey results highlight optimistic trends in capital deployment, shifting priorities in investment criteria, regional differences, and the rise of new technology verticals.

SURVEY ANALYSIS

2025 Outlook: Reinforcing the positive trends from 2024

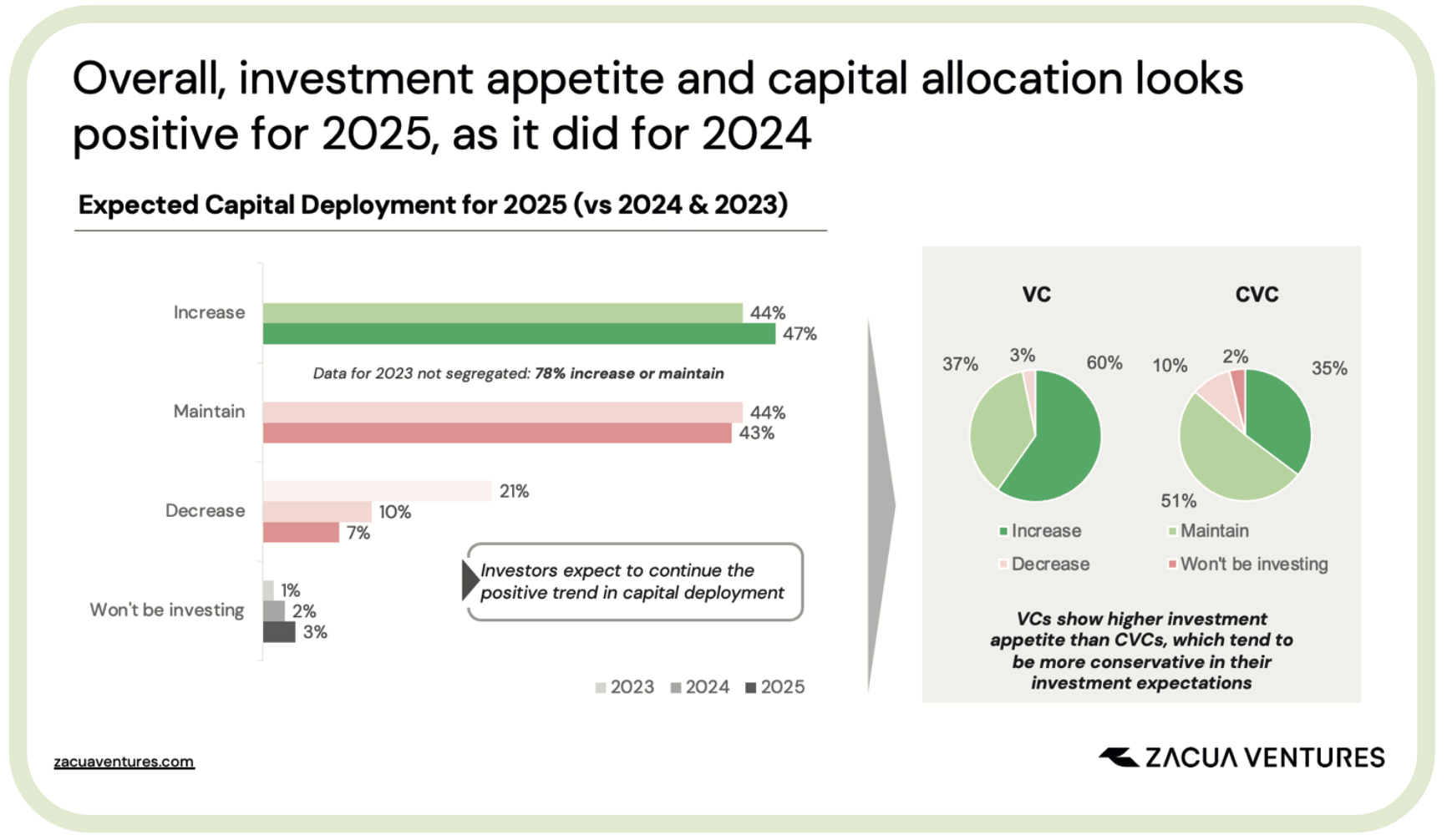

Capital deployment expectations indicate a continued positive outlook for the sector, with most investors signaling their intent to either increase (47%) or maintain (43%) their capital deployment in 2025 (90% in total, compared with 88% in 2024 and 78% in 2023). This trend reflects the recovery in early-stage ConTech investment sentiment observed since the sharp decline in 2022, indicating growing confidence in the market’s long-term potential.

observed since the sharp decline in 2022, indicating growing confidence in the market’s long-term potential.

A key distinction can be seen between VCs and CVCs: the latter have adopted a more cautious and conservative approach, with 51% expecting to maintain their investment levels, 35% expecting to increase them, and 10% expecting to decrease.

Investor concerns lowering, valuations set to rise again

The consistency in positive investment intentions suggests that investors are increasingly optimistic about the potential for growth and innovation in the ConTech sector. However, some concerns remain.

Although lower than in previous years, market uncertainty continues to be the top concern for investors. While 61% identified it as a major concern in 2023 and 40% in 2024, it remains significant for 37% of investors in 2025. Similarly, concerns about valuation corrections have followed a downward trend: 38% in 2023, 32% in 2024, and only 19% in 2025.

On the other hand, the availability of funds has become a growing concern, with a steady increase in investor apprehension since 2023 (29%, 31%, and 33%, respectively). CVCs appear more constrained, with 35% expressing this concern compared to 29% of VCs.

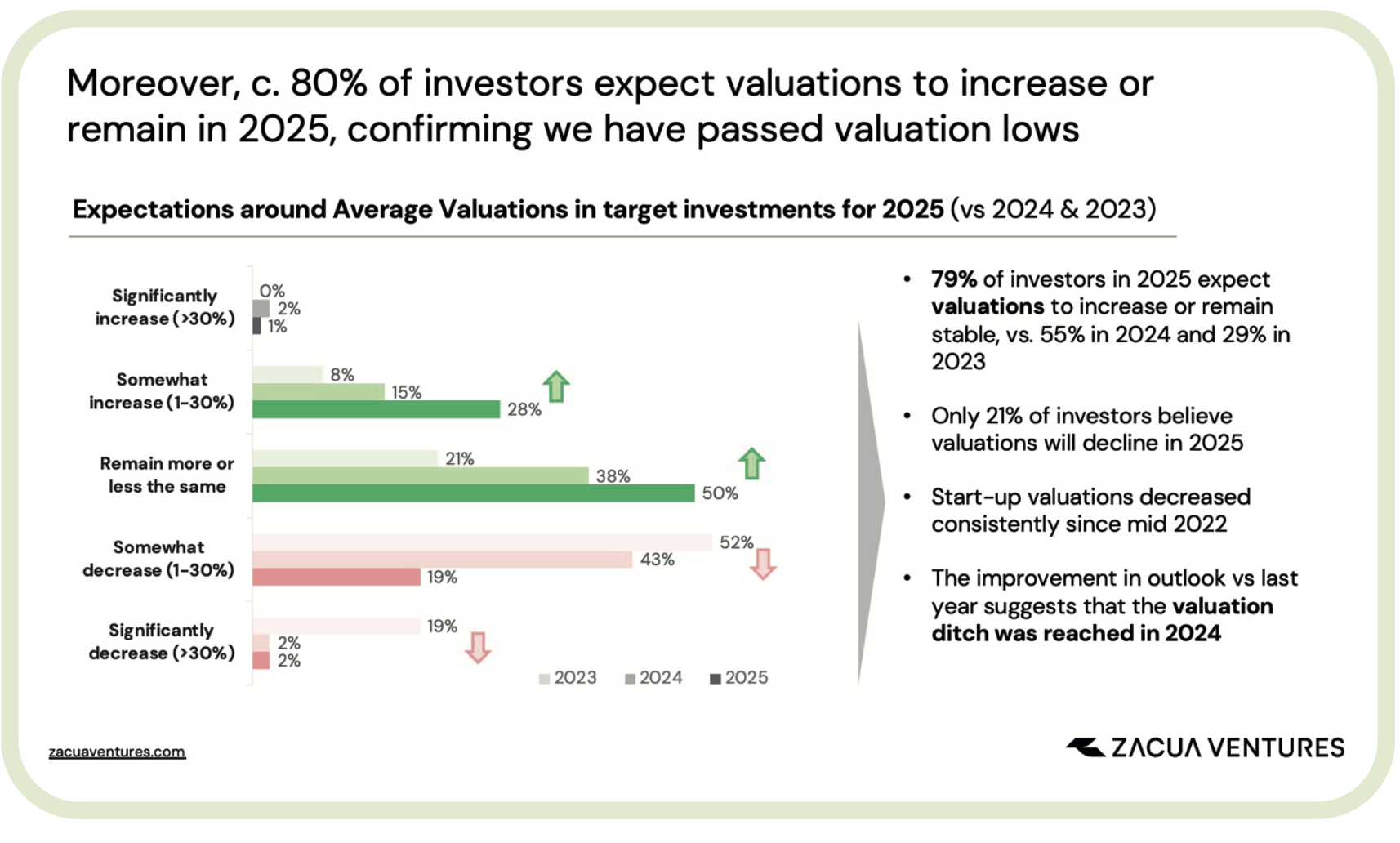

Valuation trough reached in 2024?

Expectations for average valuation changes reveal a steady and positive trend: 79% of inves- tors believe valuations will remain constant or increase in 2025, a sharp improvement compared to 55% in 2024 and 29% in 2023. Notably, almost one-third of respondents are optimistic about moderate valuation increases (up to 30%).

Given this data, along with macroeconomic trends indicating higher ConTech adoption, a positive outlook for the construction industry, and more active M&A activity, it seems likely that early-stage ConTech valuations reached their lowest levels in 2024 and are now poised for growth.

AI and Robotics on the rise, Sustainability under scrutiny

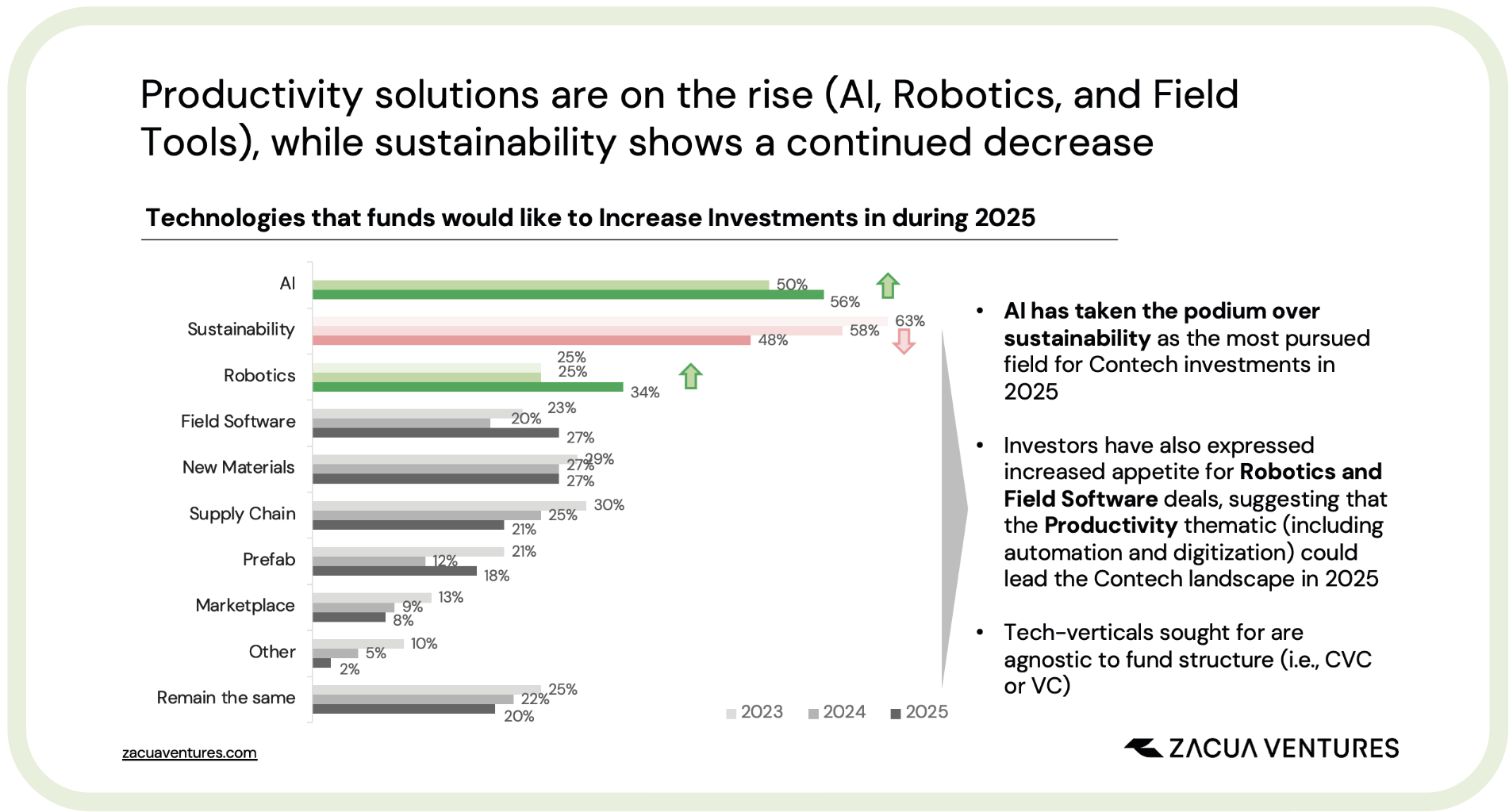

For the first time, AI emerged as the leading tech area for increased investment, with 56% of respondents planning to allocate more funds in 2025 compared to the previous year. This displaced sustainability, which experienced a sharp ten-point decline (48% in 2025 versus 58% in 2024).

Robotics also gained prominence, with a nine-point increase in relative interest (34%, up from 25%), sitting third on the podium. Innovations in robotics, including higher flexibility, multi-tasking capabilities, and reduced setup times, align with macroeconomic trends such as skilled labor shortages, paving the way for broader adoption in construction.

Investors are also experiencing the App Fatigue

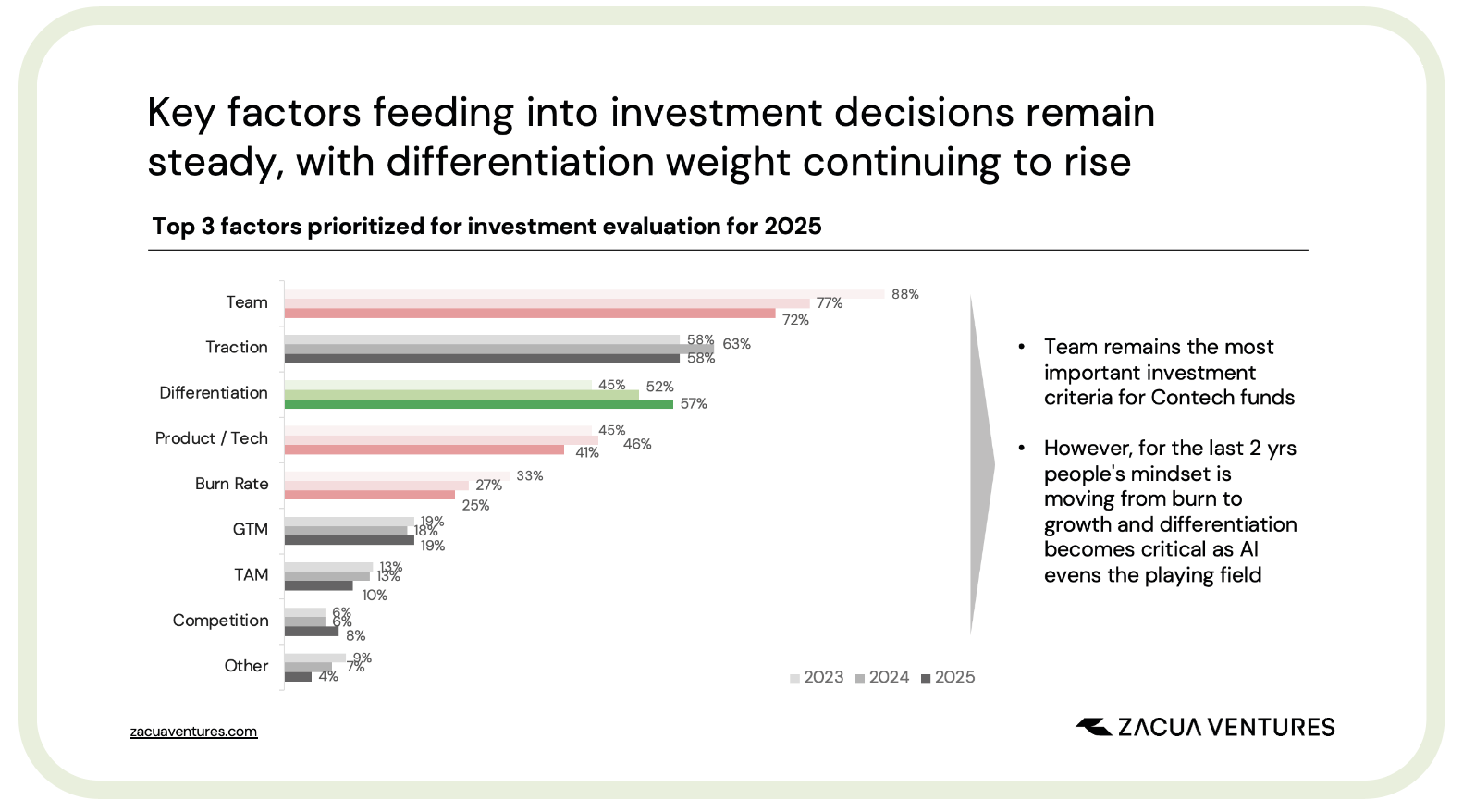

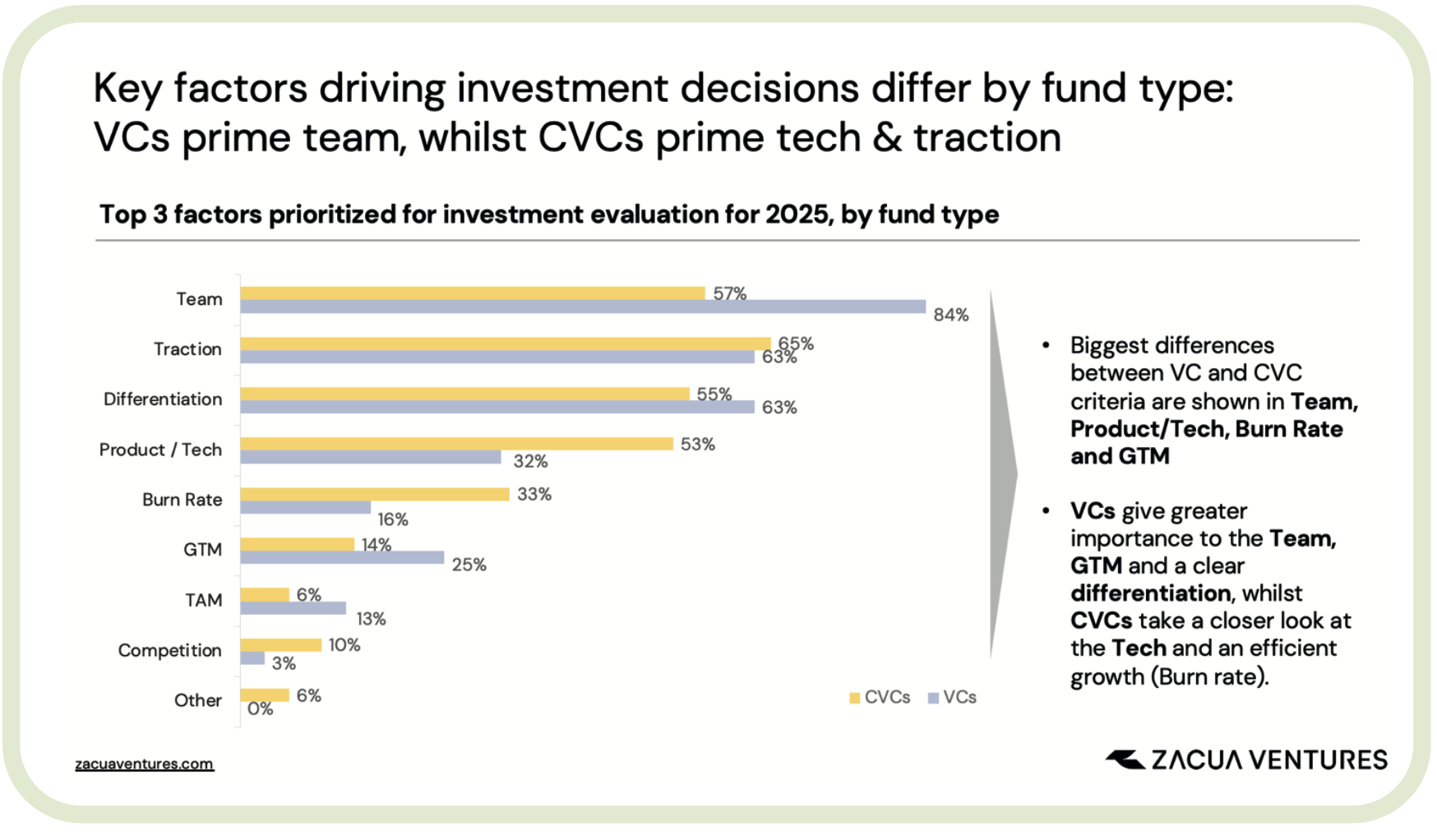

While job site workers are suffering from app fatigue due to increasingly crowded tech stacks, investors seem to be feeling a similar pain. When asked about key investment considerations, Team, Traction, and Differentiation remained the top three factors, with Differentiation gaining relative importance.

Interestingly, differences emerged between VCs and CVCs: while both prioritize the top three considerations, CVCs place greater emphasis on Product/Tech, Burn Rate, and Traction, whereas VCs focus on Team, Differentiation, and Go-to-Market (GTM) strategies (further analysis in the appendix).

SURVEY TAKEAWAYS

SURVEY TAKEAWAYS

Key changes from previous years

Having run this survey for 3 consecutive years, we can summarise the key changes we forecast for 2025 in the following points.

- Increased optimism: Investment sentiment has improved significantly, with stabilized valuations and increased capital deployment plans.

- Expectations on valuations recovery: After 2 years of continuous decline, valuation dicth should have been passed, expecting a conservative increase in 2025.

- Shift in investment criteria: Differentiation has become a critical factor in investment decisions, reflecting a competitive market for standout innovations.

- Technology focus evolution: A shift from sustainability to productivity-oriented technologies such as AI and robotics translates into a market preference for a more immediate ROI and efficiency

Drivers of optimism

This shift towards optimism in the industry is primarily driven by 3 key factors: market dynamics, financial environments, and technological advancements.

On Market dynamics, factors like housing shortages in both developed and developing economies are creating a pressing need for innovative solutions to increase output and speed. Complex infrastructure projects, growing in scale, demand sophisticated tech tools for engineering challenges. At the same time, rising construction costs, led by material and labor expenses, are pushing the sector to adopt cost-saving techs at a faster pace.

The financial environment is also playing a key role in shaping optimism: Lower interest rates are providing a much-needed boost to residential and commercial real estate markets. Additionally, the uptake in M&A activity and the recent success of ServiceTitan’s IPO have increased investors’ confidence in exit scenarios. These factors have attracted greater interest from the VC community, potentially leading to increased competition for deals and upward pressure to valuations.

On the technological front, increased contech adoption comes in hand with a shift in focus toward productivity-enhancing innovations such as AI and robotics, which are gaining precedence over traditional sustainability-focused solutions.

Don’t get us wrong, interest in sustainable techs remains strong, even as short-term policies may deprioritize carbon minimization. The industry’s focus on reducing both embodied and operational carbon continues to be a long-term priority.

Final remarks

With capital commitments trending upward and a clear focus on differentiation and innovation, the construction technology landscape in 2025 promises to offer startups more funding opportunities, creating an increasingly appealing context for founders to focus on the industry.

Regional differences persist and may become more pronounced in a world with heightened political divisions. With North America continuing to lead the funding ecosystem, higher competition in the region for funding the best startups will accelerate valuation increases, which will then be followed by other regions at a slower pace.

CVCs are expected to play a significant role in this evolving landscape. Their growing share of total tech funding, combined with more conservative criteria, a stronger focus on tech readiness, and a commitment to efficient startup growth, could help foster a more diverse startup ecosystem. This shift is particularly noteworthy given the construction industry’s traditionally risk-averse nature.

Exhibits – Answers by segments

VCs vs CVCs – What Are They Focusing On?

Positioning a startup for fundraising requires understanding the differing priorities of VC CVCs. Understanding the distinct criteria each type of investor prioritizes is critical for success.

The survey highlights these differences clearly:

Key priorities of VCs

VCs prioritize growth and finding companies that can return their fund, focusing on:

- Team quality: Voted as the top criteria by 84% of VCs, exceptional teams are seen as the foundation of a startup’s success.

- Traction and differentiation: Startups with proven market traction and a clear competitive edge are highly sought after.

- Growth potential: A strong GTM strategy and a large addressable market are critical for VCs, who emphasize scaling quickly to maximize valuation.

Key priorities of CVCs

CVCs focus on strategic alignment with their core business and innovation efficacy, proving their tend to be patient, yet more conservative investors, valuing:

- Product and technology: While team quality, traction, and differentiation remain important, CVCs stand out for their strong emphasis for innovative and differentiated solutions, reflecting their interest in synergies with business units.

- Efficient growth: CVCs favor startups with controlled burn rates and sustainable scaling over aggressive growth strategies.

- Strategic fit: Market size is less critical to CVCs; instead, they prioritize how a solution inte grates with their business and offers competitive advantages.

Geographical segmentation

When analyzing the responses by geographical scope, clear regional differences emerge, aligning with broader trends in the construction industry. It is important to note that these responses are not exclusively tied to one region, as funds often diversify their investments across multiple areas.

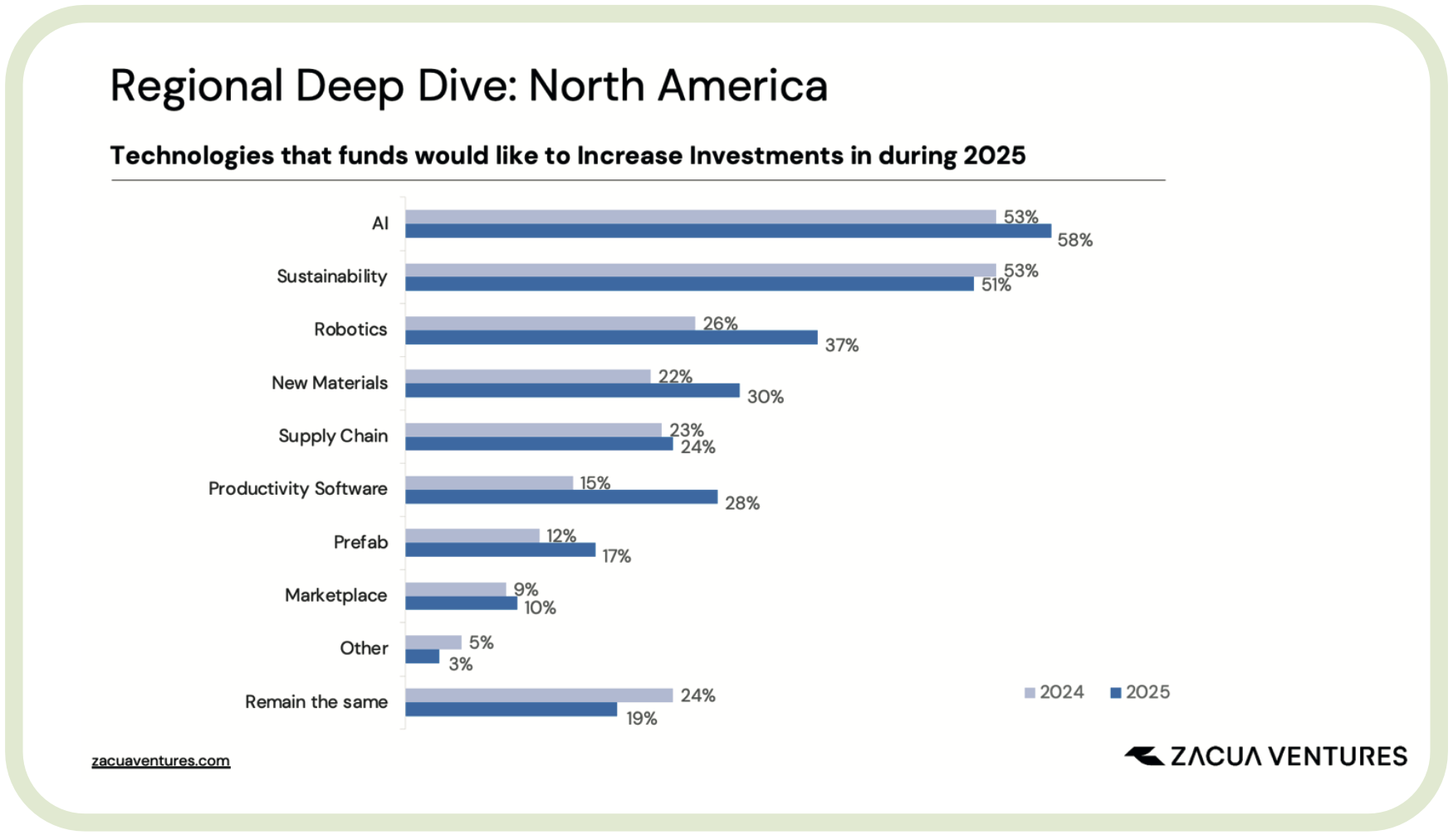

North America: With NA accounting for 60% of the total ConTech investment in 2024, half of the funds investing here are planning to increase their investment pace in 2025. This was the only region where AI ranked first in attractiveness last year, and it continues to hold the top position over sustainability this year. Robotics and new materials are the following segments, showing the highest growth from last year.

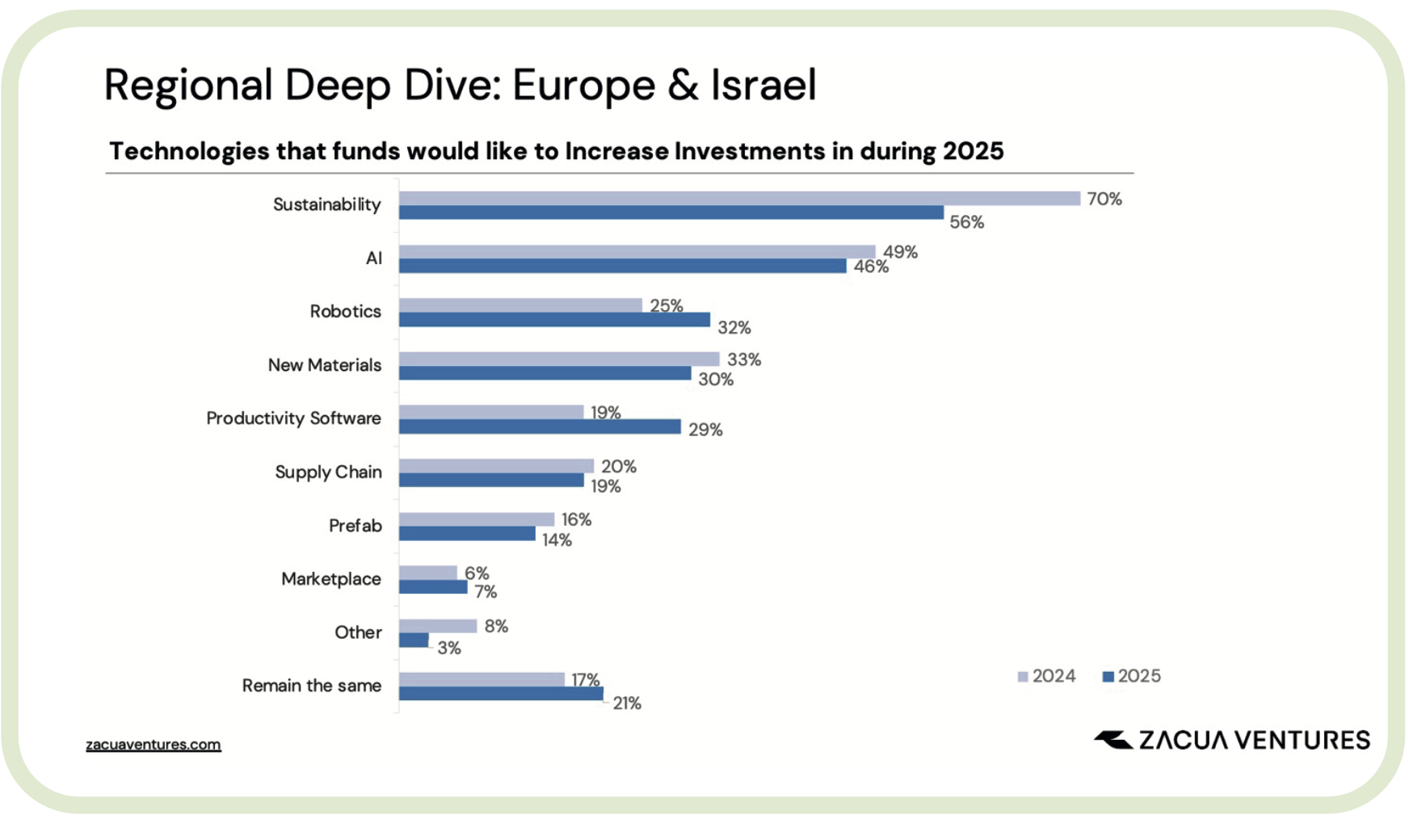

Europe & Israel: Although growth perspectives in early-stage investment appear positive, they are more conservative compared to other regions, with 46% of funds looking to increase investments and 10% expecting to reduce them. This year, Europe still ranked sustainability as its top investment priority, albeit with a significant decrease compared to the previous year.

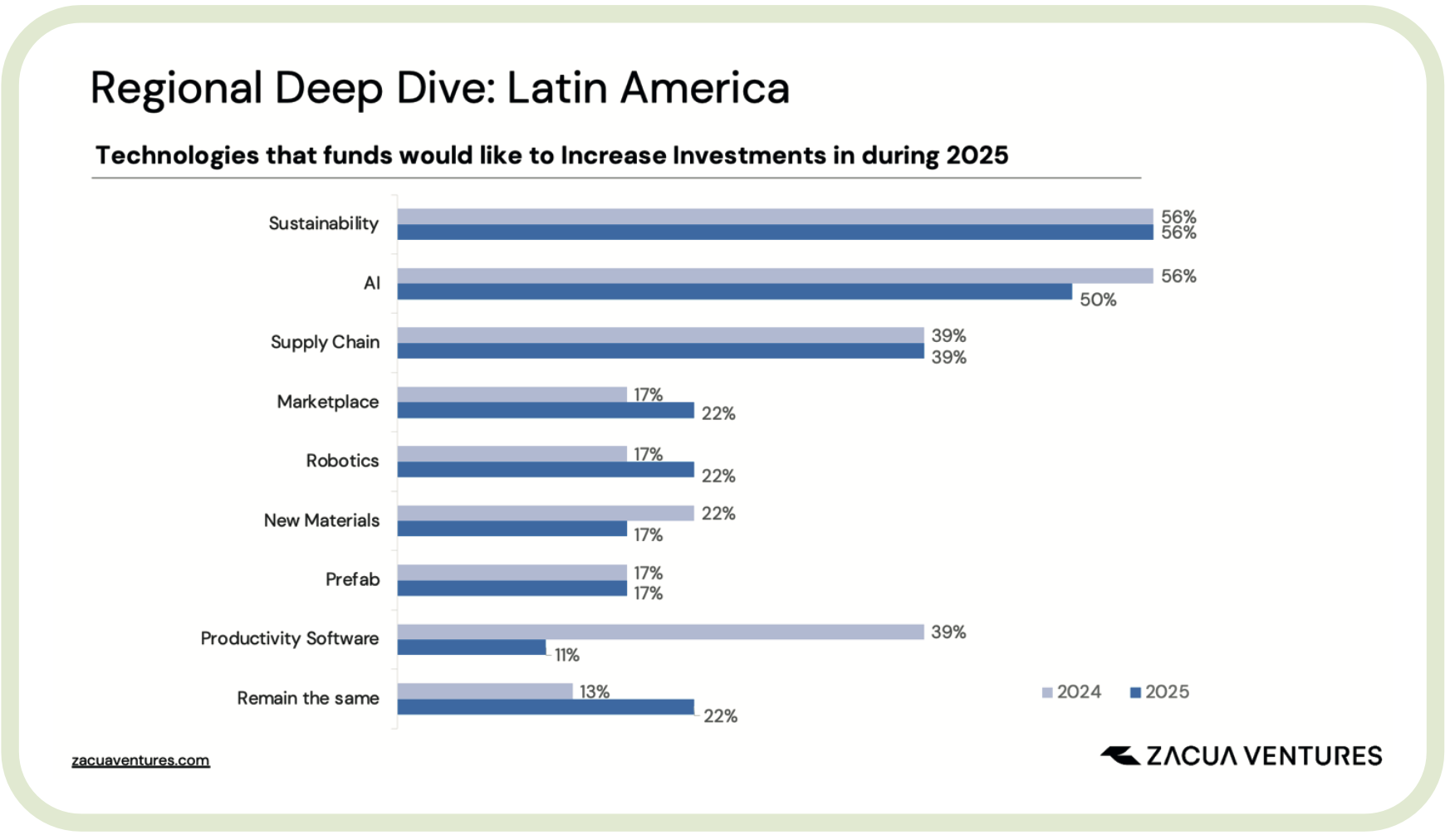

LatAm: Early-stage investors in Latin America remain optimistic, with 44% planning to increase their investments this year. The region stands out for its focus on supply chain and marketplaces, reflecting unique challenges such as logistical obstacles and a large number of small and medium-sized enterprises that have yet to be digitized. Nearshoring presents a significant opportunity, provided the necessary structures and systems are in place to support it.

Investors in the region prioritize traction (78%) above all other investment criteria. This emphasis highlights the challenges of technology adoption in the region’s construction sector and underscores the importance of demonstrating product-market fit.

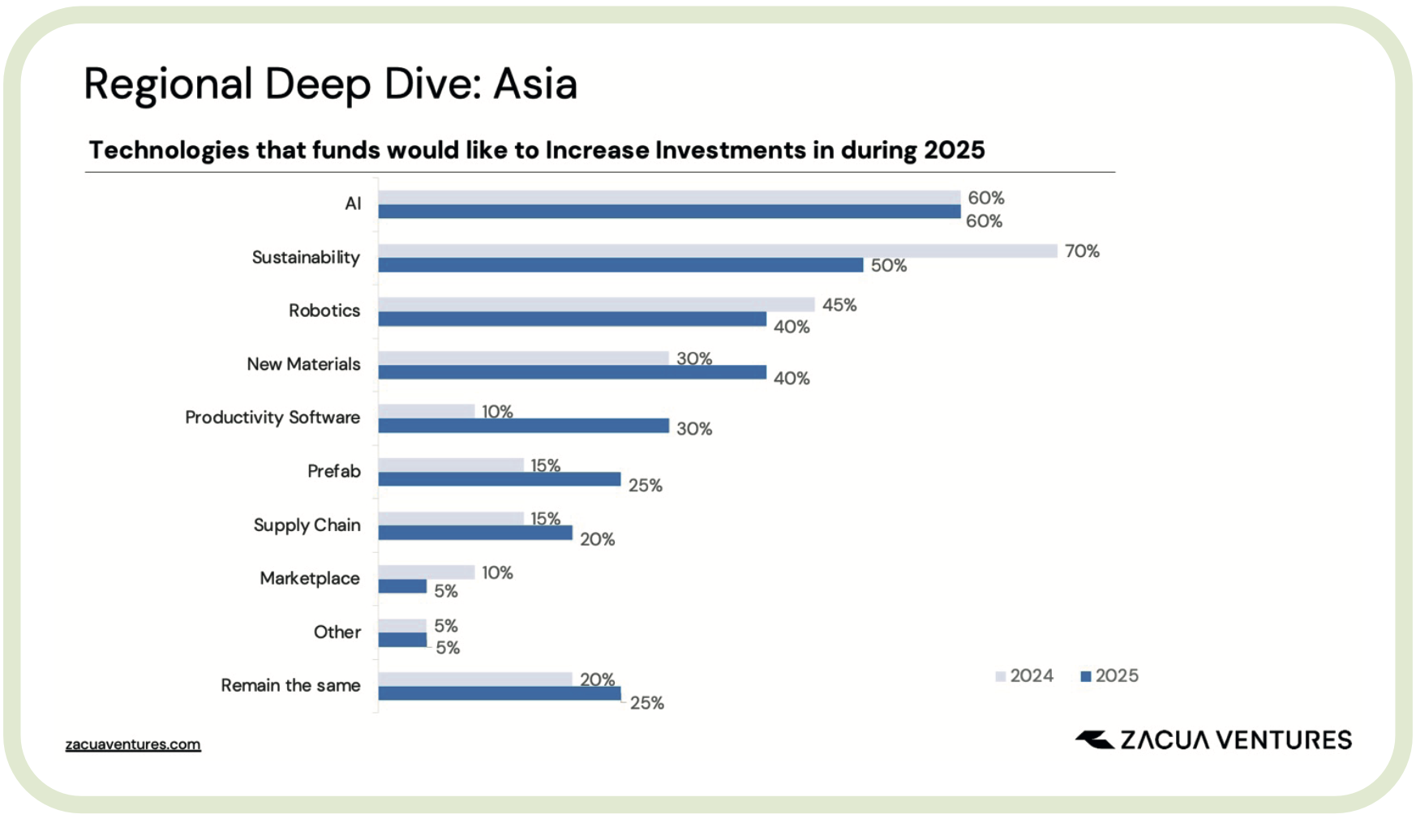

Asia: While 40% of investors in the region plan to increase their pace this year, 10% expect to decrease it. Asia, which last year stood out for its focus on robotics, now aligns more closely with other regions. AI ranks first, followed by sustainability, which has experienced a sharp decline ininterest since 2024.

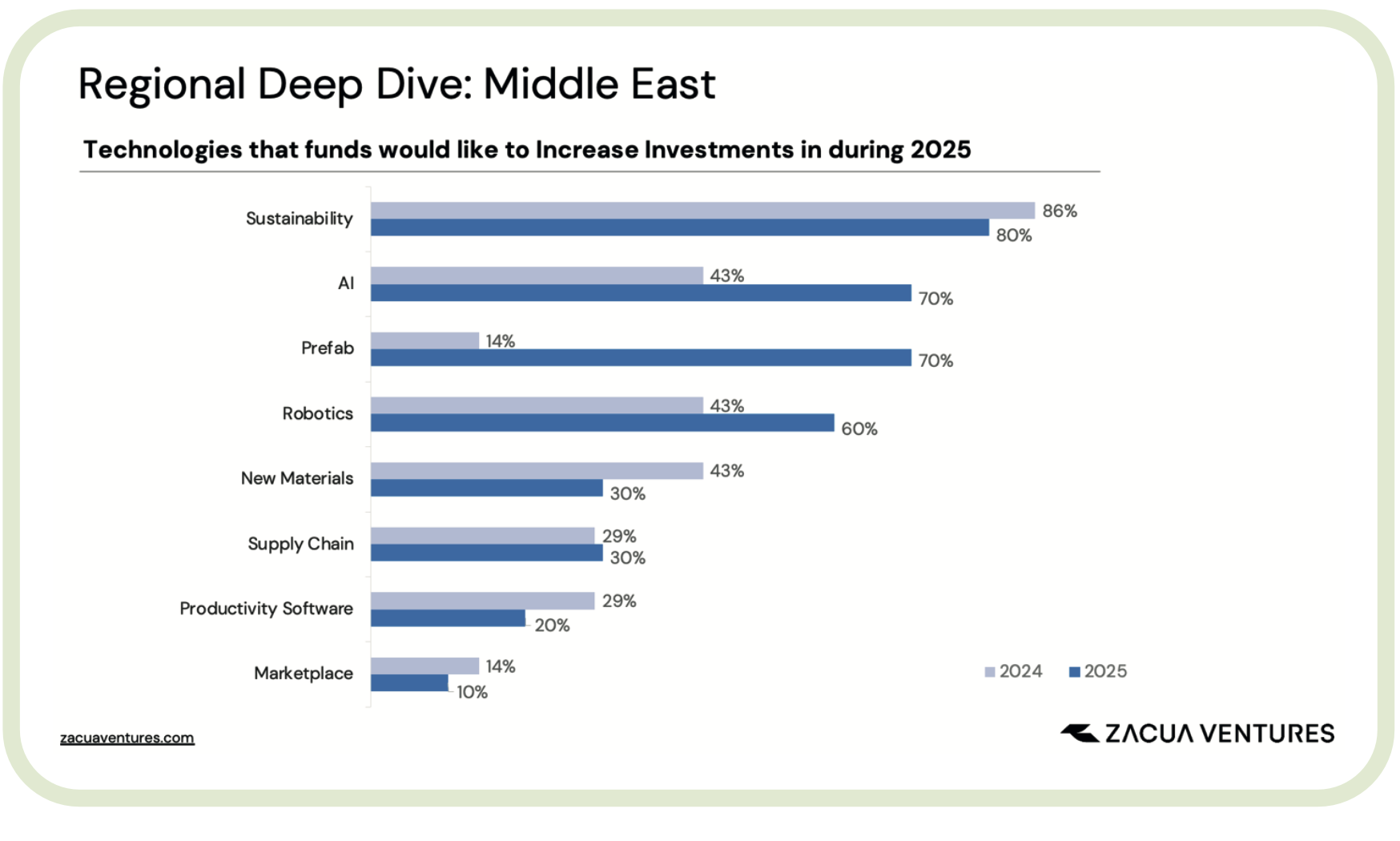

Middle East: Construction in the region is growing like nowhere else, and this growth is reflected in investors’ conviction to continue increasing their investments in ConTech (60% of funds plan to increase investments).

Sustainability maintains its leadership position, now closely followed by AI.

Interestingly, the region views modular and prefab construction as one of the preferred methods to meet demand, with an astonishing 70% of investors seeking further exposure to this area. The strong interest in robotics also highlights the need to address or replace the growing issue of skilled labor shortages.