Energy and decarbonization in industrials: transversal solutions? A framework to breakdown the challenges, map the solution space, and identify adoption barriers

The construction industry relies on vast amounts of building materials which are energy, emissions, and capital intensive to manufacture. In fact, the top 5 building materials (BMs, in short – steel, cement, ceramics, glass, and timber) account for ~15-20% of all global carbon emissions. Put into perspective of an average construction project, the embodied emissions of a building’s materials account for approx. ~20% of its total life cycle CO2 emissions. Hence, decarbonizing BM manufacturing is a crucial lever to make the built environment more sustainable – and a pressing dilemma amongst BM manufacturers.

The challenge at bay is huge – there are many aspects of heavy industry which make it forever difficult to transform. We have summarized these in 4 main areas, outlined below:

- High heat requirements: firing industrial ovens (such as cement kilns or steel blast furnaces) at temperatures well beyond 1000 deg C requires vast amounts of heat energy, not to mention they need to operate 24/7…

- Aggressive thermal ramp-ups: steep temperature gradients are required to achieve specified material properties, currently achievable by combusting fossil-fuels

- Asset-heavy nature of the industry: software won’t cut-it – most solutions will require developing and deploying new hardware, or upgrading/remodeling existing equipment

- Traditional mindsets and operating protocols: plant operators are typically skeptical and tech-averse, especially when it comes to incorporating software solutions

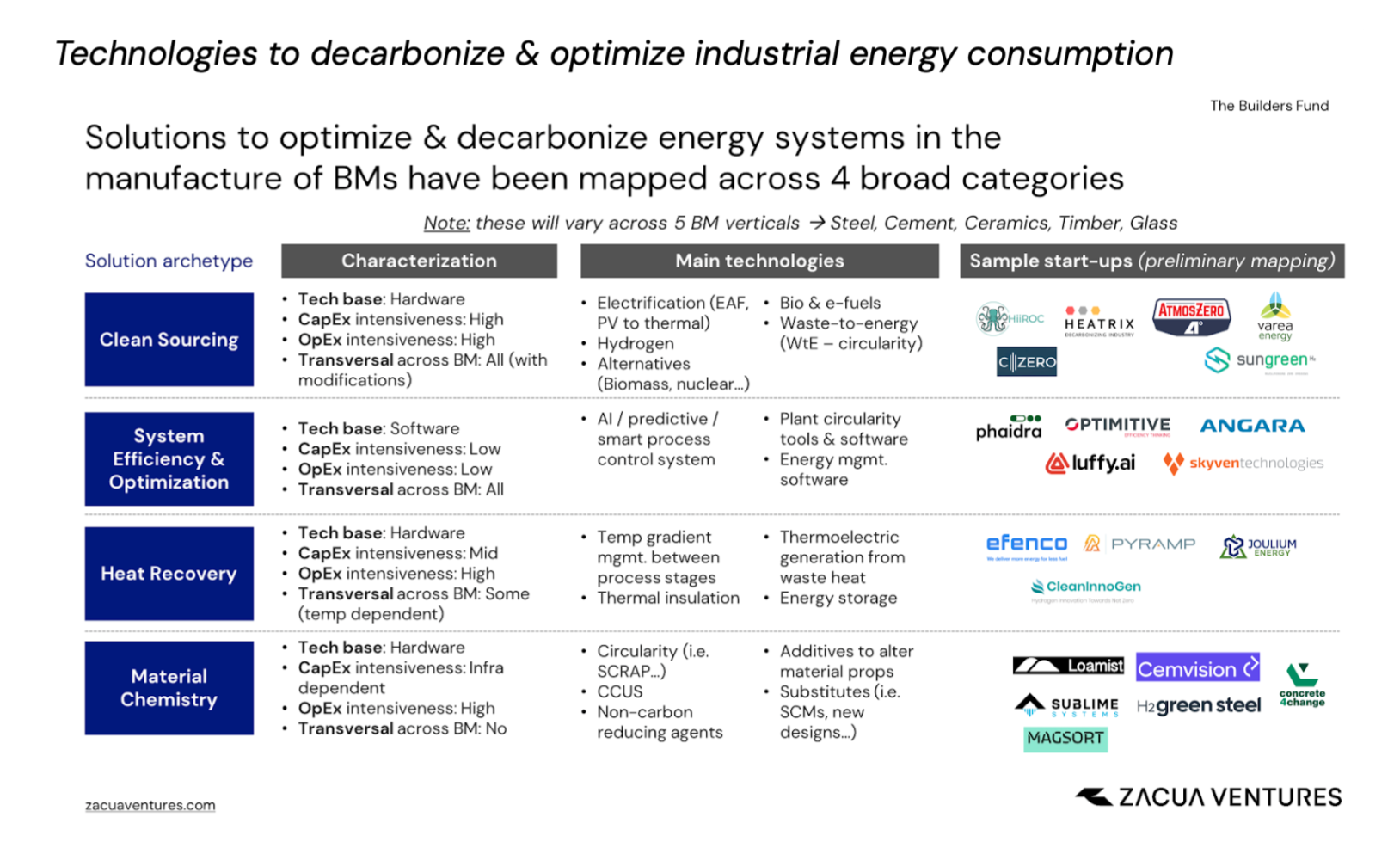

But with large challenges come large(r) opportunities – and solving these tough problems warrants a combination of technologies. Our job is to look for the most effective solutions driving this ‘green’ industrial revolution, and the first step is to characterize each ‘solution space’ – this will enable adequate comparisons to be made. Synthesizing our research from interviews with industrial players (covering 4 of the 5 BM verticals mentioned earlier), we defined 4 broad solution archetypes addressing the energy & emissions dilemma:

-

Clean sourcing: refers to any renewable or green(er) energy source, directly replacing fossil fuels to generate heat (includes hydrogen, electrification, alternatives such as biomass & nuclear, and Waste-to-Energy). Solutions will be asset-heavy in nature.

-

Process digitalization and optimization: mainly software-based solutions that aim to maximize process efficiency via predictive control systems and algorithms/LLMs that continually optimize consumption of energy as per defined output and monitored parameters (many AI-based solutions emerging under this branch).

-

Heat recovery: these are typically composed of hardware components integrated in a factory’s heating system, with complimentary software controlling the devices. Technologies span temperature gradient management, thermoelectric generation, energy storage and re-usage, and thermal insulation.

Material chemistry: solutions under this space involve re-formulation of a BM’s chemical composition to remove CO2-intensive reactions (such as calcination of limestone in cement or reduction of iron ore in steel manufacturing). They will be hardware-based, but asset-light in nature if no greenfield infrastructure is required to operate the new process.

It is worth noting that some solution archetypes will transverse across BM verticals – such as most clean/alternative sourcing and process optimization technologies – although these will also likely require tailoring to specific process parameters and supply chain dynamics. The other two technology groups (heat recovery and material chemistry) will be more BM-specific due to the nature of varied processes and raw material supplies & chemical properties needed.

Whilst there are many incentives (and soon, regulatory obligations) for industrial players to start adapting their manufacturing processes and facilities to adopt these new technologies, multiple barriers to mass-adoption exist. We highlight the main ones below:

- Lack of appropriate energy infrastructure: reliance on grid electricity (which will take decades to make fully renewable) and lacking logistics/distribiution & storage facilities are evident obstacles facing the deployment of Hydrogen and electrification solutions, for example.

- Cost-barriers: High upfront costs, additional CapEx/OpEx elements (such as plant remodelations, new or enhanced maintenance…) and lack of regulatory/tax incentives (especially in emerging markets) result in poor cost-competitiveness vs existing systems

- Regulatory approval: international standards (i.e. ISO) and certifications in the built environment involve slow and bureaucratic processes that can take up to several years to be expedited. This can slow down time-to-mkt for new technologies, consume significant time and resources of a start-up (as they are labor-intensive processes), and limit the use-cases that a technology can cover

- Feedstock availability: in most material chemistry solutions, securing a long-term, cheap supply of new raw chemicals usually becomes the bottle-neck – especially as industry verticals (such as Oil & Gas, Coal, Steel…) become increasingly circular

- Need for new infrastructure: financing greenfield projects for a novel process or technology impedes rapid scalability – players that work on a ‘lean’ approach supported by brownfield projects will have a winning business case to scale faster

- Complex and fragmented supply chains: logistical challenges result from dependencies on raw materials from abroad and/or localized nature of supply chains – these can impede manufacturers to secure a consistent supply of new materials (such as SCRAP for steel manufacturers, or other industry by-products and slags for cement producers)